Why Corporate Travel Booking Matters for Your Business

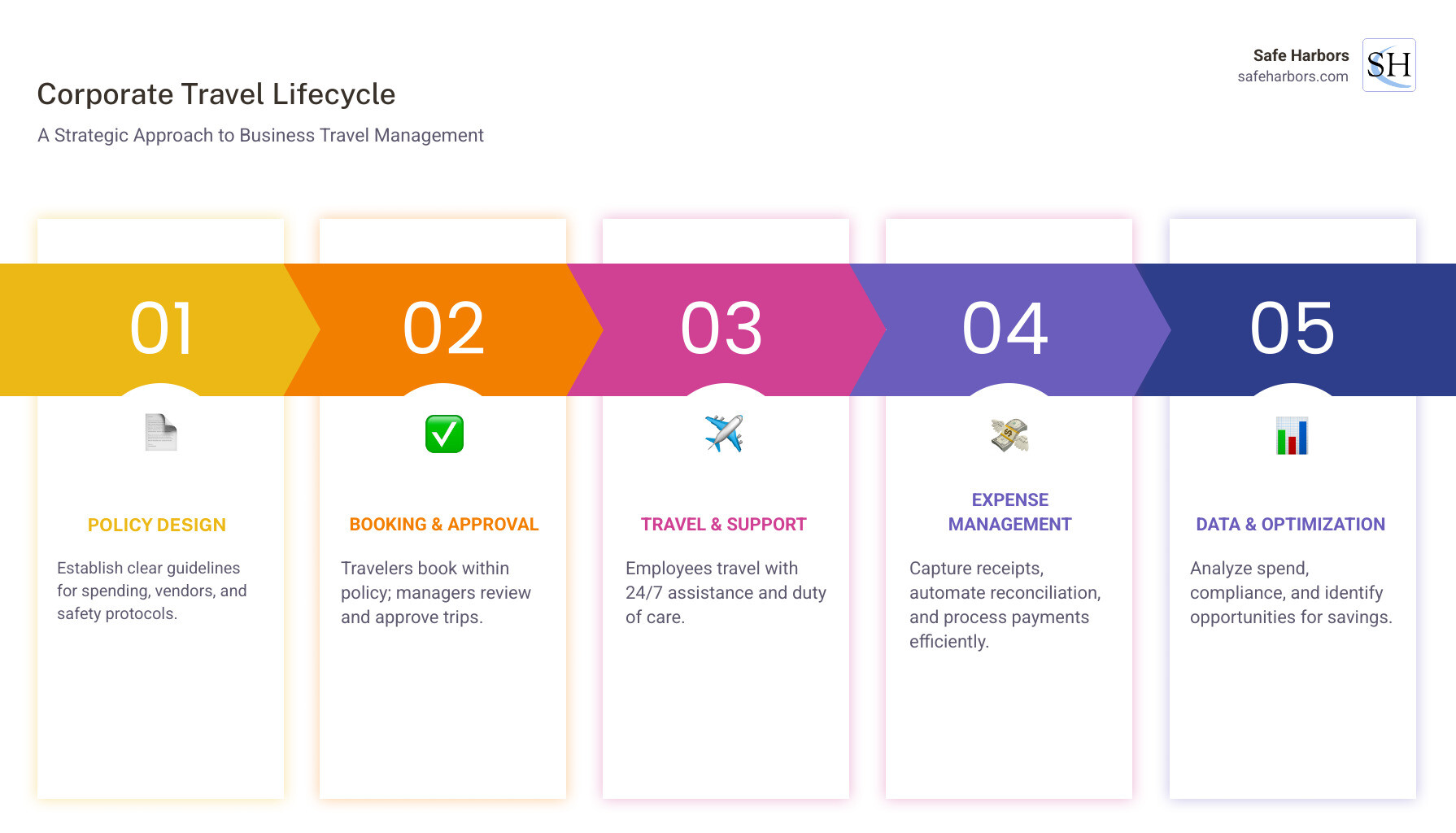

Corporate travel booking is the process organizations use to plan, reserve, and manage business trips for their employees. It's far more than just purchasing airline tickets—it's a strategic function that balances cost control, policy compliance, traveler safety, and operational efficiency across every trip your team takes.

Quick Answer: What You Need to Know About Corporate Travel Booking

- Definition: Corporate travel booking is the systematic process of planning, reserving, and overseeing business travel, including flights, hotels, ground transportation, and expense management

- Core Components: Travel policy enforcement, vendor relationships, cost optimization, and duty of care programs

- Primary Goal: Balance traveler needs (flexibility, experience) with business objectives (cost efficiency, risk mitigation)

- Key Challenge: Two-thirds of business travelers admit to booking outside company policy, even when they know the rules

- Modern Solution: Integrated booking platforms that combine intuitive technology with expert support to streamline the entire travel lifecycle

The complexity of managing corporate travel has grown exponentially. You're juggling competing priorities every day: travelers want flexibility and comfort, while your organization needs cost control and risk management. Meanwhile, outdated booking tools, slow support response times, and disconnected systems create friction at every step.

The stakes are real. Organizations lose approximately 5% of revenue to occupational fraud annually, much of it through travel and expense processes. At the same time, 58% of employees have changed travel plans because they felt unsafe—highlighting the critical importance of duty of care. Add rising costs, falling compliance rates, and pressure to demonstrate ROI, and it's clear why corporate travel management requires both sophisticated technology and strategic oversight.

As Jay Ellenby, President of Safe Harbors Travel Group, I've spent decades helping organizations transform their corporate travel booking from a source of frustration into a strategic advantage. My experience managing complex international logistics and implementing data-driven travel programs has shown me that the right combination of technology, policy design, and expert support makes all the difference.

What is Corporate Travel Management and Why is it Essential?

At its heart, corporate travel management is the engine that keeps your business moving—literally. It involves the planning, booking, and overseeing of business travel for a company’s employees. But why can't employees just book their own trips like they do for vacation?

The answer lies in the "four pillars" of management: travel policy, vendor relationships, cost control, and traveler safety. Without a structured program, you’re essentially handing out company credit cards and hoping for the best. Research shows that two-thirds of business travelers admit to deviating from company policies. That’s not just a minor annoyance; it’s a massive financial and security leak.

The Travel Policy: Your North Star

A comprehensive and quickly adaptable business travel policy is the foundation of a successful program. It sets the "guardrails" for what is acceptable spending. We help businesses create policies that aren't just restrictive lists of "nos," but helpful guides that simplify decisions. When your policy is integrated into your booking tool, travelers don't have to guess—they see compliant options immediately.

Vendor Relationships and Cost Control

When you manage travel strategically, you gain access to massive global buying power. This includes over 290 global airlines and 650,000 lodging partners. By consolidating your spend, we can negotiate preferred rates that aren't available to the general public. This goes beyond just "cheap flights." It’s about the Benefits of a Managed Corporate Online Booking Tool that identifies unused ticket credits and automatically applies them to future trips, preventing thousands of dollars from vanishing into thin air.

Operational Efficiency and Traveler Safety

Time is money. Managing Business Flight Booking manually can take hours of an administrator's day. A managed solution automates the "busy work" of approvals and reporting. More importantly, it ensures duty of care. If a crisis happens halfway across the world, you need to know exactly where your people are and have a way to get them home. With a 95% customer retention rate across the industry's top providers, it's clear that businesses value the peace of mind that comes with professional management.

The Mechanics of Modern Corporate Travel Booking

Gone are the days of calling a travel agent and waiting for a faxed itinerary. Modern corporate travel booking is powered by elite technology that rivals the best consumer apps but with the "brain" of a CFO.

AI-Powered Search and Real-Time Inventory

Modern platforms use AI to learn traveler preferences. If an employee always prefers an aisle seat or a specific hotel chain, the system prioritizes those results while keeping them within the company budget. This "smart shopping" experience uses Global Distribution Systems (GDS) and direct APIs to pull in real-time inventory. This means the price you see is the price you get—no more "ghost" fares that disappear when you click buy.

The Power of the Corporate Booking Tool

A dedicated Corporate Booking Tool acts as a single pane of glass for all travel needs. Whether it's air, hotel, car, or rail, everything is in one place. This integration allows for personalized results that balance what the traveler wants with what the business needs. To see this in action, you can Watch the demo of integrated travel tools to understand how the flow from search to expense works seamlessly.

Key Features of a Top-Tier Corporate Travel Booking Platform

Not all platforms are created equal. If your current tool feels like it was designed in 1998, it’s time for an upgrade. A top-tier platform should offer:

- User Experience (UX) You'll Love: If it’s hard to use, travelers will go to a consumer site. The best tools offer a "lightning-fast" experience where a trip can be booked in under 90 seconds.

- Mobile Accessibility: Business happens on the go. Managing travel and expenses from a mobile app isn't a luxury; it's a requirement.

- Multi-segment Itineraries: Booking a trip that goes from New York to London to Paris and back shouldn't require three separate transactions.

- The OBT Advantage: Using a managed OBT (Online Booking Tool) ensures that every reservation is tracked and compliant from the moment it's made.

- Automated Approvals: If a trip is within policy, the system should approve it automatically. If it’s not, it should trigger an immediate notification to the manager.

Integrating Expense Management with Corporate Travel Booking

One of the biggest pain points in business travel is the dreaded expense report. We’ve all been there—staring at a pile of crumpled receipts after a long trip. Integration solves this by using e-receipts. When you book through the platform, the data flows directly into the expense system.

| Feature | Manual Reporting | Integrated T&E Platform |

|---|---|---|

| Submission Time | Hours/Days | Minutes (Automatic) |

| Policy Compliance | Low (Manual Checks) | High (Built-in Guardrails) |

| Visibility | Delayed (Weeks) | Real-time |

| Fraud Risk | High (5% Revenue Loss) | Low (Audit Trails) |

| Efficiency | Baseline | 10x Gain |

By using an integrated platform, companies see a 26% increase in policy compliance and 21% annual cost savings. More importantly, it protects the business. The Association of Certified Fraud Examiners (ACFE) estimates that 5% of revenue is lost to fraud each year. Automated audit trails and reconciliation make it much harder for "accidental" overspending to occur.

Optimizing Costs and Ensuring Policy Compliance

Let’s talk about the bottom line. Every business wants to save money, but in travel, "cheap" can often be expensive if it leads to missed meetings or stranded employees. Smart corporate travel booking focuses on value rather than just the lowest price.

Negotiated Rates and Dynamic Pricing

Because we manage travel for thousands of clients globally, we have access to exclusive corporate rates. These aren't just "Genius" discounts you find on consumer sites; these are deep-inventory deals that often include perks like free breakfast, WiFi, or flexible cancellation. Furthermore, 50% of travel managers are currently seeing significant pricing pressure from suppliers. To combat this, we use dynamic pricing tools that identify real-time discounts and fare-forecasting technology to tell you the best time to buy.

Visual Compliance Indicators

The best way to get employees to follow the rules is to make the rules visible. Modern tools use color-coded indicators (like a green checkmark for "in policy" and a red "X" for "out of policy") during the search process. It’s a simple psychological nudge that works. When travelers see that a flight is out of policy, they are much less likely to book it. This leads to a 26% increase in compliance on average.

Unused Ticket Tracking

Did you know that millions of dollars in flight credits go unused every year? When a business traveler cancels a flight, that credit belongs to the company, not the individual. If you’re Looking for a New Corporate Online Booking Tool, ensure it has a robust unused ticket management feature. Our systems visualize these credits and automatically prompt the booker to use them for the next trip.

Prioritizing Traveler Safety and Duty of Care

If cost is the brain of travel management, safety is its heart. Your employees are your most valuable asset, and their well-being is paramount.

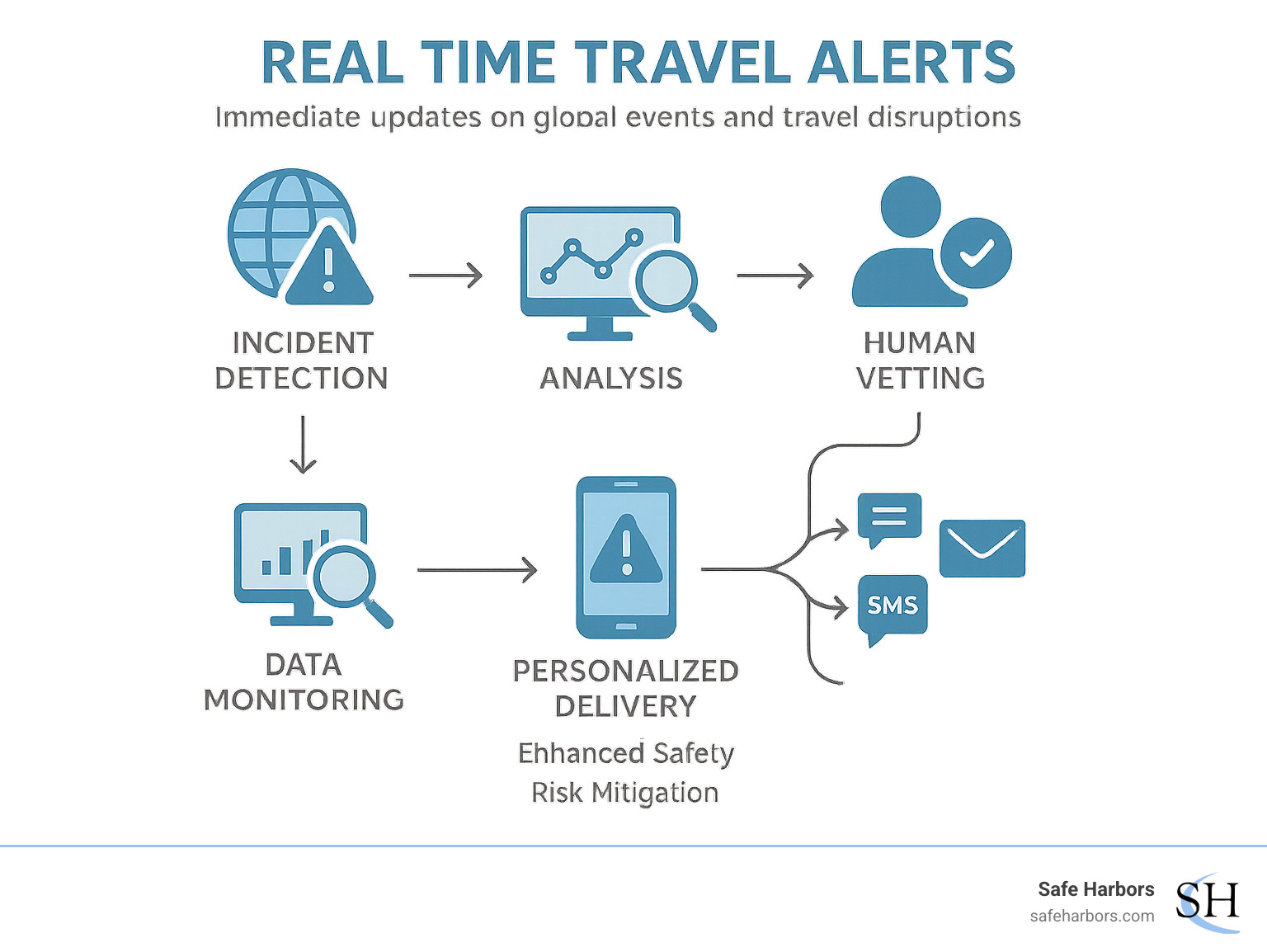

Real-Time Alerts and Risk Assessment

Before a traveler even leaves, we conduct pre-travel risk assessments. Is there a strike at the airport? A political protest? A weather event? Our systems send real-time alerts to the traveler’s mobile app and the travel manager’s dashboard. This is crucial when you consider that 58% of employees have changed travel arrangements due to feeling unsafe.

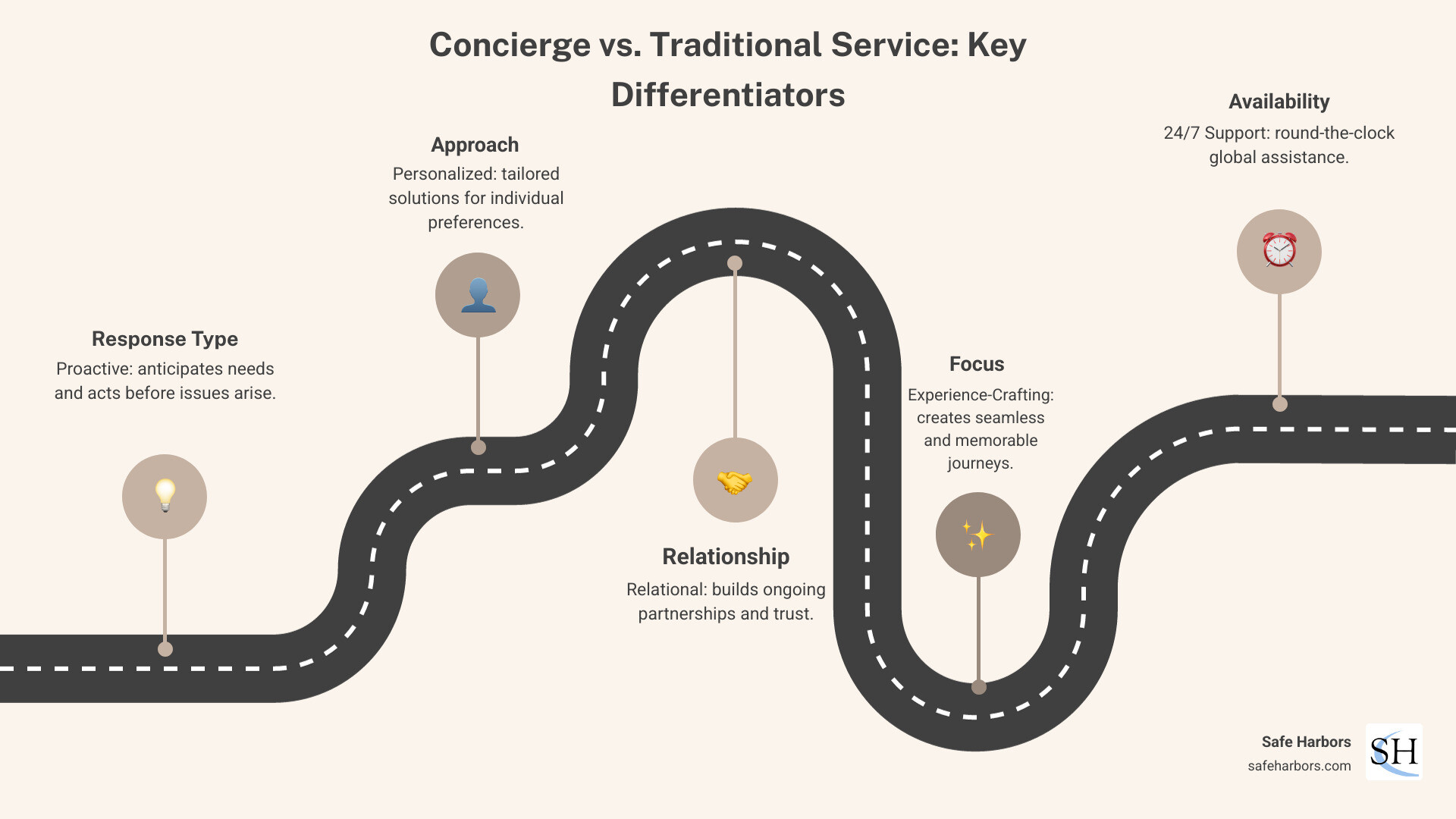

24/7 Expert Assistance: The "Human" Element

Technology is great until you’re stuck in a terminal at 2 AM in a foreign country. That’s where our white-glove service comes in. We provide 24/7 customer support with unmatched response speed. While the industry average for call wait times can be as high as 30 minutes, our gold standard is answering in seconds. Whether it’s emergency repatriation or just a last-minute hotel change, our Corporate Travel Agency Services ensure you’re never alone.

Global Tracking

In the event of a global emergency, we can "ping" every traveler in our system to confirm their safety. This level of duty of care is not just a moral obligation; in many jurisdictions, it is a legal requirement for employers. By centralizing all bookings through one platform, you have a single source of truth for where your people are at any given moment.

Future Trends: Sustainability and NDC Content

The world of corporate travel booking is changing rapidly. Two major trends are currently reshaping the landscape: sustainability and NDC.

Sustainability and Emission Budgets

Environmental impact is no longer an afterthought. Roughly 46% of travel managers now have a strategy to monitor and assign "travel emission budgets" to teams and individuals. Modern booking platforms now display the carbon footprint of various flight and hotel options, allowing travelers to choose the "greener" path. We also support businesses in finding sustainable lodging and implementing carbon-offsetting programs.

NDC Content: The New Standard

NDC (New Distribution Capability) is a travel industry-supported program launched by IATA. It allows airlines to offer more personalized content and "bundles" (like bags, seats, and WiFi included) directly to corporate booking tools. This bypasses the limitations of older GDS systems and ensures you have access to the full range of airline offers, including exclusive NDC fares that are often lower than standard rates.

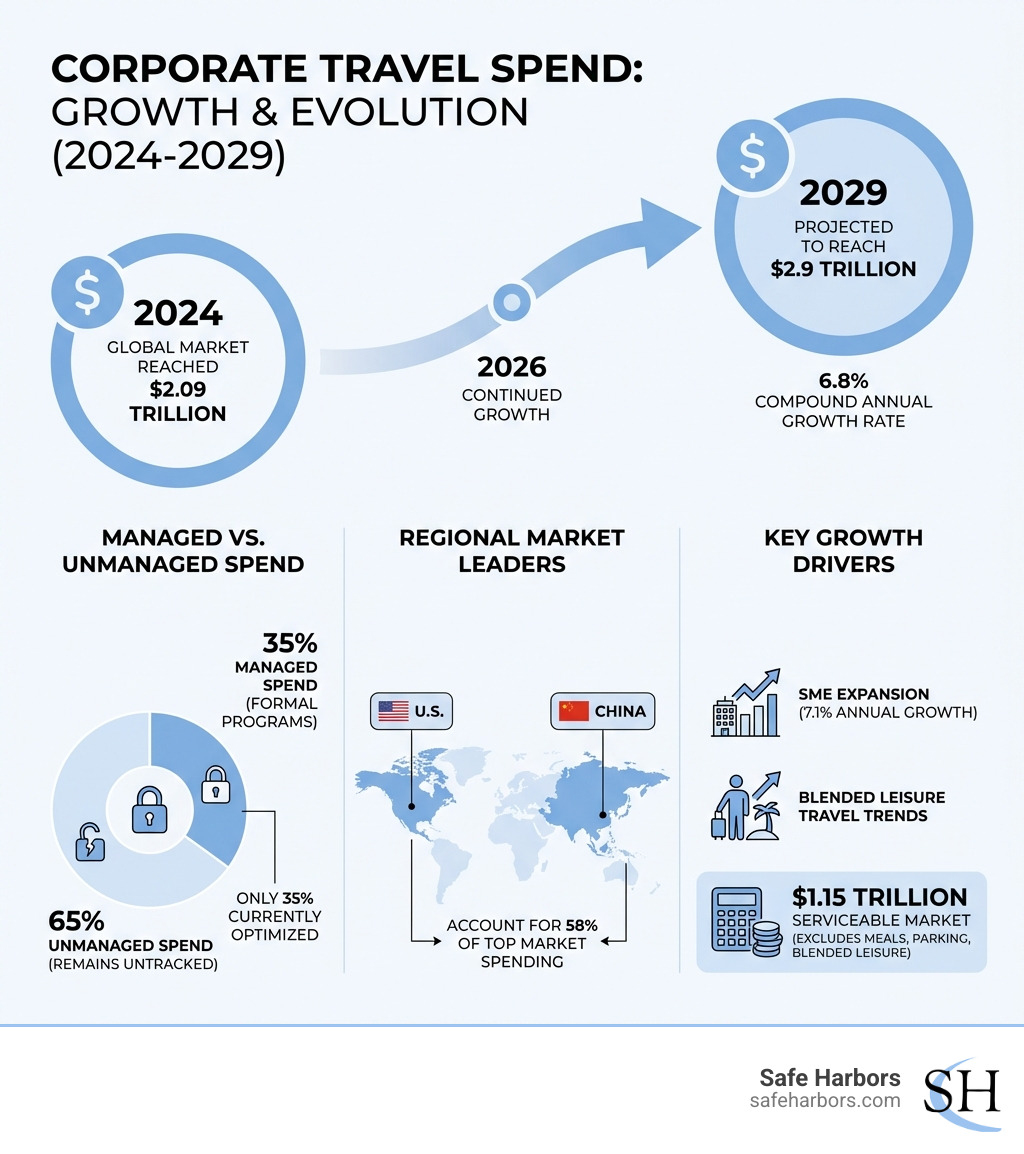

Meetings, Events, and Group Bookings

Corporate travel isn't just about the solo road warrior. We are seeing a massive surge in "bleisure" (business + leisure) and hybrid events. Our platforms support group bookings for up to nine colleagues at once and offer dedicated tools for managing large-scale meetings and events. Whether it's sourcing a venue or coordinating arrivals for 500 people, integrated technology makes it manageable.

Frequently Asked Questions about Corporate Travel

How do businesses choose the right travel management company?

The "right" TMC depends on your size and needs. Look for a partner that offers a balance of "elite tech" and "human touch." Ask about their response times, their global reach, and their ability to integrate with your existing HR and finance software. Most importantly, look for a company that treats you like a partner, not just a transaction.

What role does AI play in modern business travel?

AI is the "silent assistant." It handles the heavy lifting of data analysis, predicts fare increases, and personalizes search results. Generative AI is also being used to create "concierge-style" chat support that can handle simple rebooking tasks instantly, freeing up human managers for more complex emergencies.

How can small businesses benefit from corporate travel programs?

You don't have to be a Fortune 500 company to save money. Small and Medium Enterprises (SMEs) can leverage the "pooled" buying power of a TMC to get rates they could never get on their own. Plus, the time saved on administration allows small teams to focus on their core mission—growing the business.

Conclusion: Strategic ROI and Traveler Well-being

Managing corporate travel booking is a balancing act. It’s about finding the sweet spot where the business saves money, the finance team gets clean data, and the traveler feels supported and safe.

At Safe Harbors, we believe that travel should be an investment, not just an expense. By combining elite tech partnerships with our signature white-glove service, we ensure that your travel program is optimized for success. From 90-second bookings to 24/7 emergency support, we are dedicated to making corporate travel easy.

Ready to stop chasing receipts and start driving results? Start optimizing your travel program today and experience the difference that unmatched response speed and expert management can make for your business.