Why Business Travel Expenses Matter for Your Bottom Line

Business travel expenses significantly impact your company's financial health. Many organizations miss substantial tax savings because they don't understand what qualifies for deduction. With companies spending around $950 per employee on domestic travel annually, proper expense management is crucial for protecting your profit margins.

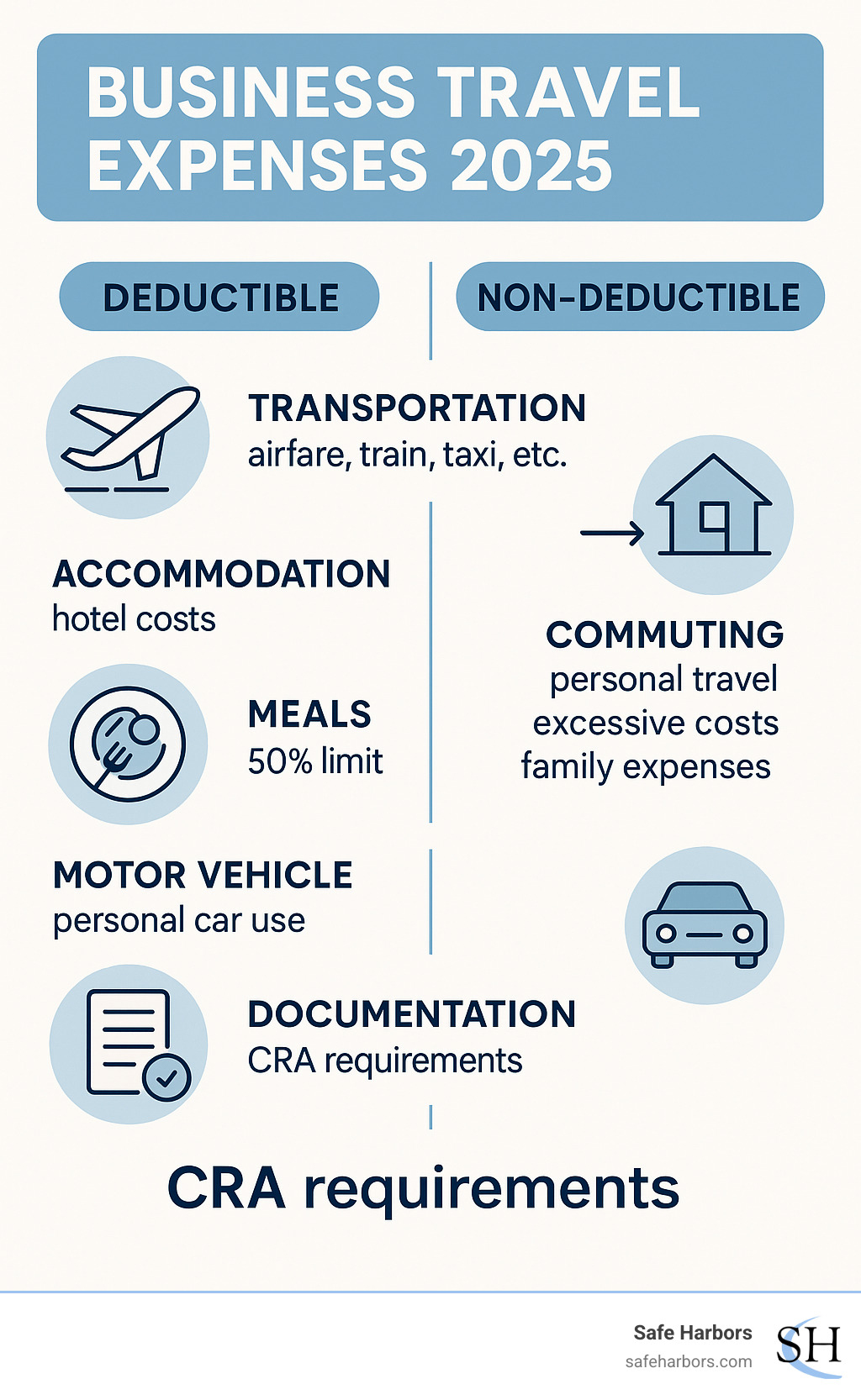

Key Business Travel Expenses You Can Deduct:

- Transportation: Airfare, train tickets, taxi fares, car rentals

- Accommodation: Hotel stays, lodging costs, business phone calls

- Meals: 50% of reasonable meal costs (with specific conditions)

- Motor Vehicle: Personal car use for business (detailed or simplified method)

- Incidentals: Parking fees, tolls, business conference fees

What You Cannot Claim:

- Daily commuting to your regular workplace

- Personal portions of mixed business/leisure trips

- Unreasonable or excessive expenses

- Family member travel costs (unless they're employees)

The Canada Revenue Agency (CRA) has strict rules separating legitimate business expenses from personal spending. Understanding these distinctions can save your company thousands in taxes and ensure you stay compliant during audits.

The key is proving that expenses are "ordinary, necessary, and reasonable" for conducting business and earning income.

As one corporate travel manager put it: "Business travel expense management is incredibly important to the success of a company. If you are working in this area then you are at the forefront of managing cash flow and overseeing one of the business's largest overheads."

Understanding What Qualifies as a Deductible Expense

The CRA's rule for business travel expenses is simple: they must be "ordinary, necessary, and reasonable" for earning business income. Essentially, would a sensible business person spend this money to make money?

Your trip needs a clear, revenue-generating business purpose. Flying to meet a client, attending an industry conference, or visiting suppliers are all deductible activities.

However, the CRA wants to know if earning income was the primary reason for your trip, not just an incidental activity. This is where many business owners stumble.

For mixed-purpose trips (or "bleisure" travel), you must prorate expenses carefully. If you fly to Vancouver for a two-day meeting and stay an extra three days to explore, only the business portion is deductible. You must divide costs between business and personal use based on time and purpose.

The key difference between commuting and business travel is your destination. Your daily drive to your regular office is personal commuting. Your drive from the office to visit a client is business travel.

For detailed guidance, see the CRA Guide T4002 Self-employed Business, Professional, Commission, Farming, and Fishing Income. To avoid common pitfalls, read our guide on the Top 15 Reasons Why Your Travel Expenses Could Be Higher Than You Expect.

What the CRA Considers Business vs. Personal Travel

The CRA uses the primary purpose rule to determine if a trip qualifies as business travel. If the main reason you traveled was to conduct business, your expenses are generally deductible. If you traveled primarily for personal reasons, they are not, even if you did some business.

Convention travel is a perfect example. If you attend a three-day conference in Toronto and extend your stay by four days for tourism, the CRA considers this a "vacation with a business component." You can deduct expenses directly related to the convention, like registration fees and hotel costs for the business days.

However, you can't claim the full airplane ticket if the primary purpose was vacation. You must allocate costs by calculating the percentage of your trip that was business-related and applying that to your transportation costs.

The vacation portion of any trip is never deductible. This means keeping detailed records of your daily activities to clearly separate business from personal enjoyment.

For the most current information, always refer to the Canada Revenue Agency guidelines.

Expenses You Cannot Claim

Not all spending during business travel qualifies as a business travel expense. Understanding the CRA's firm rules on non-deductible items can save you from tax season headaches.

Your daily commute to your regular workplace is always a non-deductible personal expense. However, travel from your office to other business locations, like a client's site, is a deductible business expense.

The personal portion of trips is another hard line. Costs for sightseeing, extra hotel nights, or personal detours are not deductible and must be separated from your business expenses.

Unreasonable expenses are also disallowed. The CRA expects prudent spending. Renting a luxury sports car or booking a presidential suite will likely raise red flags unless you can justify the business necessity.

Family member travel costs are generally not deductible unless the family member is an employee and their travel serves a documented, essential business purpose. These claims face intense scrutiny.

Bottom line: If you can't clearly explain how an expense helped you earn business income, it probably doesn't qualify for deduction.

A Breakdown of Common Deductible Travel Expenses

Let's detail which business travel expenses you can claim. This is your roadmap to understanding deductible costs and maximizing your tax return.

Most legitimate costs you incur while conducting business away from your usual workplace are deductible. This includes major expenses like flights and hotels, plus smaller ones that add up, like taxis, business calls, and laundry on longer trips.

The rule is simple: if an expense is necessary for your business and only incurred because of travel, it's likely deductible. This covers transportation, accommodation, meals (with a catch), and incidentals like parking and tips.

Most of these are fully deductible, as the CRA allows you to claim 100% of reasonable costs. For a complete breakdown of what qualifies, the CRA's travel expenses guide is your best resource.

Transportation and Accommodation Costs

Transportation and accommodation costs are your largest expenses and offer the biggest tax relief, as they are typically 100% deductible for legitimate business purposes.

Your airfare is fully deductible. While economy is standard, business or first-class may be deductible if you can justify it as reasonable and necessary, such as for long flights where you must arrive ready to work.

Train, bus, and ferry tickets are fully deductible. Local transport like taxis, ride-shares, and transit used for business at your destination are also deductible.

Car rentals for business are fully deductible, including fuel. This can be more tax-efficient than using a personal vehicle. Always choose a reasonable vehicle, as the CRA expects business choices, not joyrides.

Hotel stays are fully deductible, including extras like business calls, internet, and laundry on extended trips. The CRA considers these necessities, not luxuries, when you're away for work. If an overnight stay is necessary for business, the cost is deductible.

To learn how to keep these costs under control, check out our guide on how to reduce business travel expenses.

The 50% Limit on Meals and Entertainment

The rules for meals and entertainment expenses often cause confusion, but they are manageable once understood.

The fundamental rule is that you can only deduct 50% of reasonable meal costs when traveling for business. This applies whether you're eating alone or with a client. The CRA caps this at 50% of your actual spending or a reasonable amount, whichever is less.

A key catch is the "12-hour rule": you must be away from your work area for at least 12 consecutive hours to claim any meal expenses. If your trip is shorter, the cost is not deductible.

The 50% rule exists because you would have to eat anyway. The CRA considers it a shared cost between personal necessity and business activity.

Some exceptions exist. Long-haul truck drivers can deduct 80% of their meal costs. You may be able to claim 100% for meals provided at a charity fundraiser or if meals are integral to your business (like a restaurant promotion).

To stay compliant, keep detailed records: who you ate with, where, and the business purpose. The CRA needs proof these were business activities, not just social meals.

For employees, the CRA provides additional guidance on traveling expenses and meal deductions that's worth reviewing.

Always be reasonable. A lavish meal requires strong business justification. Spend as a prudent businessperson would to stay compliant.

Claiming Motor Vehicle Expenses for Business Travel

Using your personal vehicle for business is a major business travel expense and a valuable deduction. Kilometers driven for client meetings, supplier visits, or job sites can lead to significant tax savings.

The CRA offers two calculation methods, but both require a detailed logbook separating business and personal use. This logbook is mandatory, regardless of the method you choose.

Your logbook is crucial for tax season and audits. It must record the date, destination, business purpose, and kilometers driven for each business trip.

Smartphone apps can simplify logging. The key is consistency; make it a habit to record every business trip.

The Detailed Method

The detailed method is for those who want to maximize deductions. It lets you claim a portion of all actual vehicle costs based on your business-use percentage.

With this method, you track all vehicle spending, including fuel, oil, insurance, repairs, maintenance, and licensing fees. You can also claim Capital Cost Allowance (CCA) for the vehicle's depreciation.

A portion of lease payments or interest on car loans is also deductible, subject to CRA limits.

To calculate your deduction, multiply total vehicle expenses by your business-use percentage. For example, if your total costs were $8,000 and your business use was 72% (18,000 business km / 25,000 total km), you could deduct $5,760.

The detailed method is best for those with higher vehicle costs (e.g., high mileage, expensive repairs). It's more paperwork but can yield a larger deduction.

The Simplified (Flat-Rate) Method

For simplicity, the CRA's simplified method lets you claim a flat rate per business kilometer instead of tracking actual expenses.

According to the Department of Finance Canada's 2024 announcement, the 2024 rates are 70 cents per kilometer for the first 5,000 business kilometers, and 64 cents for each additional kilometer. These rates cover all operating costs.

Even with the simplified method, you still need a detailed logbook to prove your business kilometers. You just don't need to track individual receipts for vehicle costs.

The best method depends on your situation. The flat rate may be better for older cars with low costs, while the detailed method is often superior for vehicles with high expenses.

The smart move is to calculate your deduction both ways and choose the higher amount. Tax software or an accountant can help.

Mastering Record-Keeping and CRA Compliance

Proper documentation is your financial insurance for business travel expenses. Meticulous records are your defense against CRA audits and the key to maximizing deductions. Without them, valid expenses can be disallowed, costing you thousands.

You don't need to be a bookkeeping expert. The CRA accepts digital and paper records. Digital solutions are often easier to manage and back up, reducing the risk of lost receipts.

If you're registered for GST/HST, you can claim input tax credits on deductible business travel expenses, reducing the net tax you owe. Ensure your receipts clearly show the GST/HST paid.

Keep all records for at least six years, as the CRA can audit within this period. Organized records make audits smoother and, as noted in The Business Travel Manager's Dilemma: Keeping Finance and Your Travelers Happy, help manage cash flow and overhead.

Essential Documentation for Your Claims

The CRA requires concrete proof that expenses were legitimate, reasonable, and for business. Vague estimates are not accepted. Here's what you need for bulletproof claims.

Each receipt must show the date, vendor, amount, and a description of the purchase. For GST/HST registrants, the tax amount must also be visible. Ensure receipts are legible.

For meals and entertainment, add context to the receipt. Note the business purpose and names of guests, such as "Lunch with client Sarah Johnson to discuss Q1 contract."

Bank and credit card statements are proof of payment but are not sufficient on their own. The CRA needs to see what you bought, which requires the original detailed receipt.

For vehicle expenses, a detailed logbook is critical. Record the date, destination, purpose, and kilometers for each business trip. Do not try to recreate this from memory later; the CRA can spot inconsistencies.

For each trip, record start/end dates, locations, and the business purpose. For mixed-use trips, a detailed itinerary separating business and personal activities is crucial for allocating costs correctly.

The CRA's official guidance emphasizes comprehensive documentation, and you can find detailed requirements on the CRA's website. Their message is clear: when in doubt, document everything.

How to Claim Your Business Travel Expenses

Claiming business travel expenses differs for self-employed individuals and employees, but both can lead to tax savings if done correctly.

Self-employed individuals report travel expenses on Form T2125, Statement of Business or Professional Activities, using Line 9200 - Travel expenses.

Employees use Form T777, Statement of Employment Expenses, to claim travel costs that their employer required them to pay without reimbursement.

Crucially, employees need a signed Form T2200, Declaration of Conditions of Employment from their employer. This confirms you were required to pay for expenses and were not reimbursed. Without it, the CRA will disallow your claim.

After completing Form T777, enter the total on Line 22900, Other employment expenses on your tax return. Keep both Form T777 and the signed T2200 for your records in case the CRA requests them.

Employee claims face stricter scrutiny to ensure expenses were required by the employer. However, proper documentation makes the tax savings worth the effort.

Best Practices for Managing and Reducing Your Travel Spend

Effective management of business travel expenses is more than tracking receipts. It's about a smart system that saves money, improves morale, and streamlines operations. Since travel is a major budget item, getting it right directly impacts your bottom line.

Properly managing VAT on travel can lead to recoveries of 5% to 25%. This requires systems that actively spot savings opportunities. As detailed in our guide on 5 More Benefits of Corporate Travel Management, the benefits go beyond cost control.

Good expense management is a win-win: finance gets visibility, travelers get clear guidelines and fast reimbursements, and the business controls a major overhead cost.

Creating a Clear Travel Expense Policy

A travel expense policy is a roadmap for your team. It prevents overspending and simplifies the process for everyone.

Spending limits prevent budget surprises. Set reasonable caps for hotels, flights (economy class is standard), and meals based on location. The goal is to be budget-conscious without being restrictive.

A pre-approval process for large expenses like international trips or major client events prevents budget overruns and ensures alignment with company expectations.

A clear and fast reimbursement timeline is crucial for employee satisfaction. Prompt repayment shows you value your team and respect their personal cash flow.

Preferred suppliers offer savings through negotiated corporate rates. Directing your team to these vendors consolidates spending and improves your negotiating power.

A solid policy generates spending data, which is key for negotiating corporate discounts with suppliers. Without a tracking system, you miss these opportunities.

Communicate your policy effectively via email, your intranet, and training sessions. For more guidance, see our insights on Creating and implementing a travel expense policy.

Leveraging Technology and Services

Manually tracking business travel expenses is inefficient and error-prone. With nearly 20% of reports containing errors, the process wastes time and money.

Expense management software streamlines travel costs. Employees can snap receipt photos, and expenses are automatically categorized and checked against policy. This speeds up approvals and reimbursements.

Mobile apps are a game-changer, allowing travelers to log expenses in real-time. This improves accuracy and eliminates end-of-trip paperwork.

Corporate spending cards eliminate the need for employees to pay out-of-pocket. They provide real-time spending visibility and integrate with tracking software, removing the cash flow burden from your team.

Partnering with a travel management company like Safe Harbors pays off. We combine technology and best practices into a seamless solution, offering fast support and flexible booking tools that integrate with your systems.

Our comprehensive white-glove service and best response speed set us apart. We provide concierge management with full duty of care, optimizing every trip for cost and compliance. You get the benefits of technology without the management headaches.

The data insights from our system help you identify savings and negotiate better rates, making the technology pay for itself. Learn more at How Safe Harbors streamlines travel management.

Frequently Asked Questions about Business Travel Expenses

We often see the same questions about business travel expenses. Let's tackle the most common ones to help you avoid costly tax season mistakes.

Can I claim travel expenses for my spouse or family member?

The answer to this common question is generally, no. The CRA considers expenses for accompanying family members to be personal, not deductible business travel expenses.

The only exception is if your spouse or family member is an employee whose presence is essential for a documented business purpose, such as giving a presentation or providing a specialized service.

The CRA scrutinizes these claims, so you need rock-solid documentation of their specific, essential business contributions. A vague reason like "helped with networking" is not sufficient.

What are the rules for attending a business convention?

Attending business conventions is often a legitimate business travel expense, but the CRA has specific rules to prevent abuse.

You can deduct costs for up to two conventions per year, provided they are directly related to your business or profession.

The convention must be held within your organization's territorial scope. For most Canadian businesses, this means Canada. International conventions may qualify if directly related to your global operations.

Deductible costs include registration fees, transportation, and accommodation. Meals are still subject to the 50% rule. If you extend your stay for personal reasons, you must prorate your expenses.

Are travel insurance premiums a deductible expense?

Yes, travel insurance premiums are generally deductible as a necessary business travel expense. The CRA views this as a reasonable precaution.

The insurance must cover the business portion of your trip. For mixed-use trips, you must allocate the insurance cost accordingly.

Keep your premium receipts to substantiate your claim. It's a deductible expense that also protects you from unforeseen events.

Conclusion

Effectively managing business travel expenses is a secret weapon for your company's financial health. Understanding CRA rules, keeping detailed records, and using smart strategies builds a foundation for sustainable growth.

Success lies in claiming the right expenses correctly. Distinguishing between business and personal travel, understanding the 50% meal rule, and tracking vehicle expenses protects you from audits and maximizes savings.

Meticulous record-keeping is your insurance policy. Receipts and logbooks are proof of a professional operation. This detail saves tax money and streamlines financial management, providing clear visibility into a major expense.

Strategic planning is key. Clear policies, modern technology, and experienced partners can transform travel into a competitive advantage, with savings of 5% to 25% that can be reinvested into your business.

For comprehensive support, partner with a travel management company like Safe Harbors. We understand that every detail matters and that every traveler needs support.

Our team provides the expertise and technology to manage your business travel expenses seamlessly and in full CRA compliance. We handle the details so you can focus on what you do best: building relationships, closing deals, and growing your business.

Explore global travel management solutions and find how the right partnership can transform your travel program from a cost center into a strategic advantage.