Why Spend Category Analysis is Critical for Financial Control

Spend category analysis is the systematic process of organizing, examining, and evaluating your company's expenditures across different spending categories to identify cost-saving opportunities and improve procurement strategies. It transforms chaotic financial data into clear, actionable insights that drive better business decisions.

Quick Answer - The 8 Types of Spend Analysis:

- Direct Spend Analysis - Raw materials and components for products

- Indirect Spend Analysis - Operating expenses like office supplies and services

- Supplier Spend Analysis - How much you spend with each vendor

- Category Spend Analysis - Spending within specific categories (IT, travel, marketing)

- Item-Level Spend Analysis - Individual product or service analysis

- Payment Term Spend Analysis - Cash flow and payment timing optimization

- Maverick Spend Analysis - Unauthorized or off-contract purchases

- Tail Spend Analysis - Small, frequent purchases that add up

Companies often allocate 60-80% of their revenue to external spending, yet many struggle with fragmented data and missed savings. Consider that over 80% of procurement leaders feel their indirect spend is mismanaged due to scattered data. Furthermore, nearly 1 in 5 expense reports contain errors, and companies lose roughly 5% of annual revenue to fraud or inappropriate spending.

The solution lies in understanding the different lenses through which you can analyze your spending. Each type of spend analysis reveals unique insights—from identifying rogue purchases that bypass procurement policies to uncovering opportunities to consolidate suppliers and negotiate better terms.

For corporate travel managers, spend analysis is even more critical. Travel expenses are a significant portion of indirect spend, yet they're often the most difficult to control due to urgent booking needs, policy exceptions, and scattered approval processes.

The 8 Key Types of Spend Analysis Explained

Think of your company's spending as a puzzle. Each type of analysis is a piece, and together they create a complete picture to transform cost management. Let's walk through the eight essential types of spend category analysis to uncover hidden savings and gain financial control.

Direct vs. Indirect Spend Analysis

The first thing to understand is that not all spending is created equal. Your company's expenses fall into two distinct buckets, each requiring a different approach.

Direct spend is the money that goes directly into making your products or delivering your services. If you manufacture cars, this includes steel, tires, and engines. This spending directly impacts your Cost of Goods Sold (COGS), so managing it well is crucial for maintaining healthy profit margins.

Indirect spend covers everything else needed to run your business: office supplies, marketing campaigns, IT services, utilities, and yes—corporate travel. While these expenses don't show up in your final product, they are essential for day-to-day operations.

The challenge is that indirect spend is notoriously difficult to manage. Over 80% of procurement leaders admit their indirect spend isn't properly controlled, as data is often scattered across different departments and systems.

The good news? Companies that tackle this head-on see real results. Take the Dräxlmaier Group, an automotive supplier that implemented automated spend management for both direct and indirect purchases. By digitizing their procurement processes, they gained the visibility they needed to negotiate better deals and eliminate wasteful spending.

Supplier Spend Analysis

Now let's look at your spending through the lens of who you're buying from. Supplier spend analysis is like getting a report card on all your vendor relationships.

Understanding how much you spend with each supplier creates negotiation leverage. For example, finding you spend $200,000 annually with a seemingly small supplier across various departments justifies a conversation about volume discounts.

Supplier consolidation becomes possible when you see the full picture. You might be buying similar services from five different vendors when two strategic partners could handle everything more efficiently. This isn't just about saving money—it's about risk mitigation. You'll spot when you're too dependent on a single supplier and can diversify before problems arise.

Smart companies segment their suppliers based on strategic importance. Some are strategic partners deserving long-term contracts, while others are transactional vendors providing commodity services. Knowing the difference helps you invest your energy where it matters most.

The key is gathering all your purchase orders, invoices, and contracts into one place. This comprehensive view helps you build stronger relationships with key suppliers and ensure your supply chain is reliable and cost-effective.

What is Category Spend Analysis?

Category spend analysis is where things get really interesting. This approach organizes your spending by function or type—IT, marketing, facilities, and the big one we care about: business travel.

Think of it as giving each department or function its own financial report card. When you break down spending this way, you can see exactly where your budget allocation is working and where it isn't. Maybe your IT spending seems reasonable until you realize half of it is duplicate software licenses across departments.

This analysis is particularly powerful for spotting maverick spend—those purchases that happen outside your approved channels. If your marketing category suddenly shows unusual spikes or purchases from non-approved vendors, you've found a problem that needs fixing.

Business travel costs deserve special attention here. Corporate travel represents a significant chunk of most companies' indirect spending, and it's one of the hardest categories to control. Between last-minute bookings, policy exceptions, and scattered approval processes, travel expenses can quickly spiral out of control.

The solution is getting granular with your travel data. Break it down by airfare, hotels, ground transportation, meals, and incidentals. Look at spending by department, by individual traveler, and by trip purpose. This level of detail reveals patterns you never knew existed and opportunities for savings you never imagined.

When you have this visibility, you can make informed decisions about travel policies, preferred vendors, and booking procedures that actually stick.

Item-Level Spend Analysis

Sometimes you need to zoom in even further and look at individual products or services. Item-level spend analysis takes you down to the SKU-level data, where you can see exactly what you're buying, how much you're paying, and who you're buying it from.

This granular approach reveals some eye-opening insights. You might find you're buying the same office chairs from three different suppliers at three different prices. Or that your facilities team is purchasing cleaning supplies at retail prices while your procurement team has negotiated bulk rates with a different vendor.

Price variance analysis becomes your best friend here. When you can compare prices across suppliers and time periods for identical items, you'll spot opportunities for purchase consolidation that can lead to significant savings. Instead of buying 100 widgets from ten different suppliers, you can negotiate bulk discounts by buying 1,000 widgets from your best vendor.

The key is identifying duplicate purchases across departments and bringing them together under unified procurement strategies. This streamlines your processes and gives you the volume leverage you need for better negotiating bulk discounts.

Payment Term Spend Analysis

Here's a type of analysis that many companies overlook, but it can have a huge impact on your cash flow optimization. Payment term spend analysis isn't about what you buy—it's about how and when you pay for it.

Smart suppliers often offer early payment discounts if you can pay invoices within 10 or 15 days instead of the standard 30. But without analyzing your payment patterns, you might miss these opportunities entirely. On the flip side, poor payment timing can result in late payment fees that add up quickly.

This analysis helps you understand your current payment cycles and identify opportunities to align payment cycles with revenue. Maybe you can negotiate longer payment terms with suppliers during your slow season, or take advantage of early payment discounts when your cash flow is strong.

Supplier negotiations become much more productive when you have data on your payment history. You can show suppliers that you're a reliable payer and use that track record to negotiate better terms. Some companies save thousands annually just by optimizing their payment timing.

Maverick Spend Analysis

Maverick spend is like having a leak in your financial bucket. It's money flowing out through unauthorized purchases that bypass your established procurement policies and approved processes.

Rogue spending happens when departments make purchases without following your guidelines or using approved vendors. Maybe someone needs office supplies urgently and orders from the first supplier they find online instead of using your preferred vendor. Each individual purchase might seem harmless, but collectively they undermine your procurement process adherence.

The real problem with maverick spend isn't just the higher prices—it's the contract leakage. When purchases happen outside your negotiated contracts, you lose all the pricing and terms you worked hard to secure. Plus, you lose visibility into what's being bought and why.

Controlling maverick spend requires a two-pronged approach. First, make it easier for employees to buy through approved channels than to go rogue. Second, implement regular spending reviews to catch unauthorized purchases quickly. Many successful companies provide easy access to pre-approved supplier lists and check purchase orders against existing contracts to maintain policy compliance.

Tail Spend Analysis

Tail spend might sound insignificant, but it follows the 80/20 rule in a way that can surprise you. These numerous small, low-value purchases often represent about 20% of your total spending but account for roughly 80% of your purchase orders.

Think about all those low-value purchases your company makes: coffee for the break room, small office supplies, minor maintenance items, and miscellaneous services. Individually, none of these transactions seems worth managing. But when you add them up, they create both a significant expense and a high transaction volume that's expensive to process.

Tail spend analysis reveals strategic sourcing opportunities hiding in plain sight. Maybe you're buying coffee from six different vendors when one supplier could handle everything at better rates. Or perhaps small maintenance purchases could be consolidated under a single service contract.

The key is consolidating small suppliers where it makes sense. You're not trying to manage every $50 purchase individually—you're looking for patterns where multiple small purchases could be grouped together for better pricing and simpler administration.

When you tackle tail spend effectively, you free up both money and administrative time that can be better used elsewhere in your business.

The Core Process of an Effective Spend Category Analysis

An effective spend category analysis program is an ongoing journey, not a one-time project. It requires a systematic approach to turn messy financial data into clear, actionable insights. Much like organizing a garage, it involves gathering, sorting, and organizing your financial data to create a sustainable system.

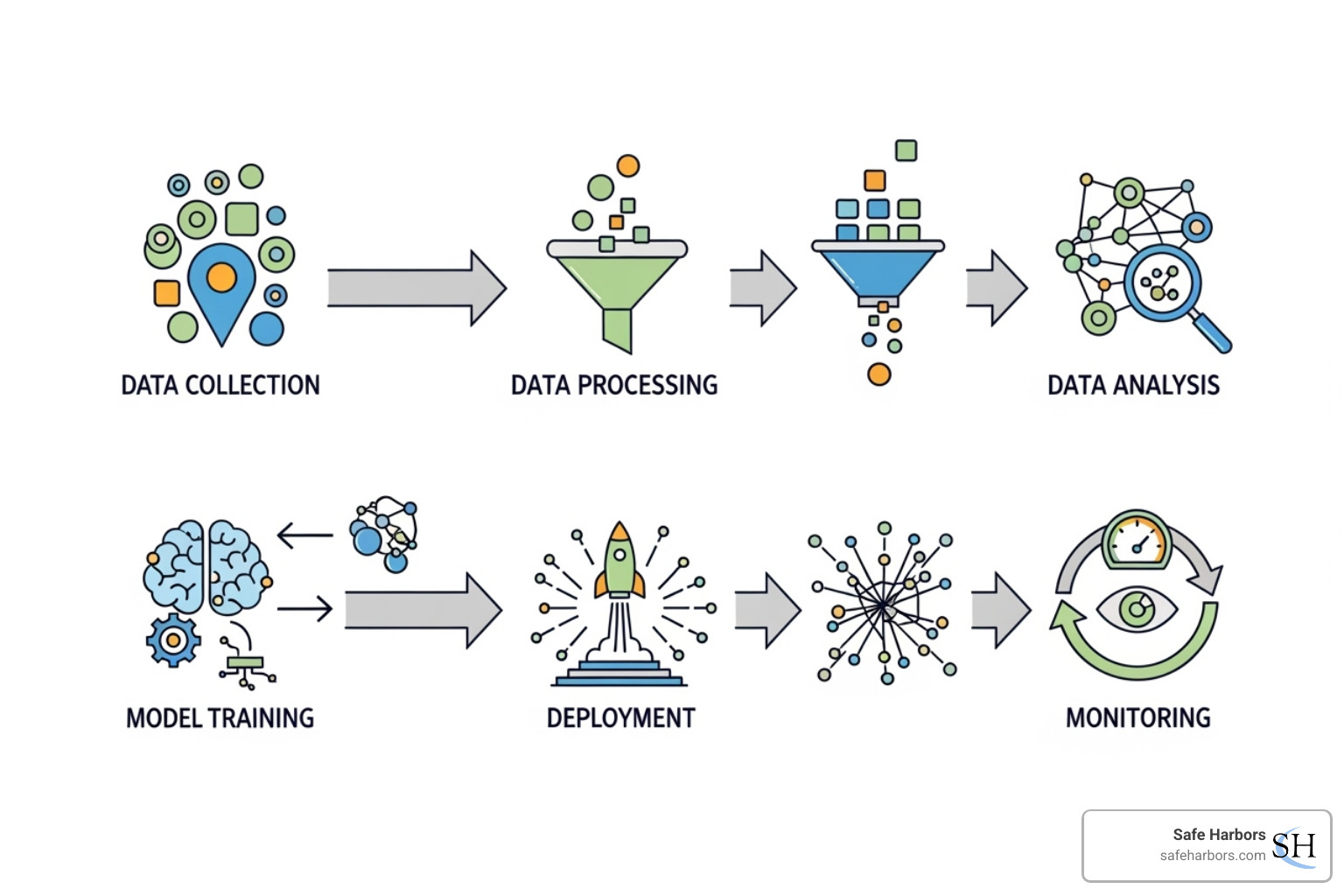

Key Steps in the Analysis Process

Following a structured, six-step process gives you the best chance of success with your spend category analysis efforts.

Step 1: Identify & Consolidate Data Sources is where most companies realize how scattered their spending information is. You'll need to gather data from ERP systems, accounts payable records, invoices, purchase orders, expense reports, and individual business units.

Step 2: Cleanse & Standardize Data is a critical step. Raw data is often full of duplicates, errors, and inconsistencies. Manual entry creates problems, which is why many organizations use intelligent automation to improve accuracy. AI-powered data cleansing can significantly cut down on manual preparation time.

Step 3: Classify & Categorize Spend involves organizing expenditures into a logical spend taxonomy. While generic systems like the United Nations Standard Products and Services Code (UNSPSC) exist, they often don't fit a business's specific operations. It's better to create a custom taxonomy that reflects your supply market and business needs for more relevant decision-making.

Step 4: Analyze & Identify Opportunities is where the magic happens. With clean, categorized data, you can apply analytics to spot spending patterns, trends, and potential cost-saving opportunities. This is when you find things like paying different prices for the same items or identifying high-value suppliers.

Step 5: Develop & Implement Strategy turns your insights into action. Based on what you've learned, you'll develop concrete strategies like renegotiating contracts, consolidating suppliers, or implementing new policies.

Step 6: Monitor & Track Progress ensures your efforts stick. You'll continuously monitor spending and track the impact of your strategies. This lets you measure success, make adjustments, and ensure sustained improvements through regular reporting.

Key Metrics and KPIs to Track

To measure if your spend category analysis is working, you need to track the right metrics. Cost Savings is the obvious one—the total money saved through your initiatives.

Spend Under Management (SUM) tells you what percentage of your total spend is actively managed by procurement. Contract Compliance Rate reveals what percentage of spending follows negotiated contracts, highlighting policy effectiveness.

Supplier Performance metrics like on-time delivery and order accuracy help you evaluate supplier relationships. Procurement ROI shows the return on investment from your procurement activities, with some organizations achieving up to a 63x return using advanced analytics.

Maverick Spend Percentage tracks spending that happens outside approved channels, which you'll want to minimize.

For corporate travel, there's a delicate balance between finance goals and employee needs. While cost savings matter, traveler satisfaction, safety, and productivity are equally important. Our analysis helps ensure travel policies are cost-effective without making employees miserable, reducing traveler burnout and supporting well-being.

Best Practices for Spend Category Analysis

Getting your spend category analysis program right requires following proven best practices.

- Automate data collection: Manual entry creates errors and delays. Intelligent automation streamlines data collection from systems like ERPs and expense tools, enhancing accuracy. AI-powered tools can provide on-demand insights for faster, more confident decisions.

- Establish a clear spend taxonomy: A good taxonomy is the backbone of your analysis. It should reflect your supply market and business needs for granular, consistent categorization.

- Enrich data with external sources: Combine your internal spend data with external market intelligence, price benchmarks, and industry trends. This provides a more comprehensive analysis and helps validate your performance.

- Foster cross-departmental collaboration: Spend analysis requires teamwork across finance, operations, and other departments. Addressing data silos is critical, as lack of collaboration is a key reason indirect spend is mismanaged.

- Link analysis to strategic goals: Ensure your analysis supports broader objectives like cost reduction, risk mitigation, or sustainability. This provides a foundation for forecasting and strategic planning.

When you implement these best practices, you'll gain improved visibility, stronger negotiation power, better policy compliance, and a more streamlined operation. For corporate travel management, these practices can significantly reduce costs while maintaining the quality of service your employees expect.

Frequently Asked Questions about Spend Analysis

We know that diving into spend category analysis can feel overwhelming at first. Over the years, we've helped countless organizations steer this journey, and certain questions come up time and again. Let's tackle the most common ones together.

What is the main difference between spend analysis and cost analysis?

This is probably the question we hear most often, and it's a great one because these terms do sound similar but serve very different purposes.

Spend analysis gives you the big picture view of your organization's purchasing habits. Think of it as your financial bird's-eye view that answers the fundamental questions: What are we buying? Who are we buying from? How much are we spending? When we conduct spend category analysis for our clients, we're looking across their entire travel program to spot patterns, identify savings opportunities, and find ways to consolidate suppliers.

Cost analysis, on the other hand, zooms way in. It's like putting a single expense under a microscope to understand every component that makes up its total cost. If spend analysis tells you that your company is spending $500,000 annually on business travel, cost analysis would break down exactly why a specific trip to London cost $3,200 instead of the budgeted $2,800.

Here's a real-world example: Our spend category analysis might reveal that your organization is spending too much on airline tickets overall. The subsequent cost analysis would then examine specific routes, booking timing, cabin classes, and airline choices to understand the why behind those higher costs.

Why do spend analysis projects often fail?

We've seen this happen more times than we'd like to admit, and it's honestly heartbreaking because the potential benefits are so significant. The good news? Most failures are completely preventable once you know what to watch out for.

The biggest culprit is poor data quality. You've probably heard the phrase "garbage in, garbage out," and it couldn't be more true here. When your expense data comes from multiple systems - maybe your ERP handles some purchases, credit card statements capture others, and individual expense reports fill in the gaps - inconsistencies are almost inevitable. We've worked with companies where the same hotel chain was recorded under five different names across various systems.

Lack of a clear process is another major stumbling block. Without a defined methodology for collecting, cleaning, and analyzing data, projects can quickly become chaotic. We've seen teams spend months gathering information only to realize they can't compare it meaningfully because different departments were tracking things differently.

Inconsistent data collection across departments creates those dreaded data silos. Marketing might track their travel expenses one way, while sales uses a completely different approach. When it comes time to analyze overall spending, these inconsistencies make comprehensive analysis nearly impossible.

Many organizations also fall into the trap of using inadequate tools. While spreadsheets are great for many things, they quickly become overwhelming when you're trying to analyze complex spending patterns across hundreds of suppliers and thousands of transactions. The manual work involved often leads to errors and, frankly, analyst burnout.

What is a spend cube?

A spend cube might sound technical, but it's actually a beautifully simple concept that makes complex spending data much easier to understand and work with.

Imagine your spending data as a three-dimensional cube that you can slice and dice from different angles. Each dimension gives you a different lens through which to view your expenditures:

The "Who are we buying from?" dimension focuses on your suppliers. This helps you identify your key vendors, spot opportunities for consolidation, and understand your supplier relationships. For corporate travel, this might reveal that you're working with twelve different travel agencies when two strategic partners could handle everything more efficiently.

The "What are we buying?" dimension breaks down your purchases into logical categories like IT services, marketing expenses, or business travel. This is where spend category analysis really shines, helping you understand budget allocation and identify categories that might be over or under-funded.

The "Who is doing the buying?" dimension shows which departments or business units are responsible for different types of spending. This often reveals fascinating patterns - like finding that your engineering team is booking significantly more expensive flights than other departments, which might indicate they're booking last-minute due to urgent client needs.

By rotating this cube and examining it from different angles, you can quickly spot trends, anomalies, and opportunities that might be invisible when looking at flat reports or spreadsheets. It's this multi-dimensional view that makes spend cubes such a powerful tool for strategic decision-making.

Conclusion: Turning Insights into Strategic Action

We've walked through the eight different types of spend analysis together, and by now, you can see how each one offers a unique window into your company's financial habits. Spend category analysis isn't just another business buzzword—it's your roadmap to understanding where every dollar goes and why it matters.

The beauty of a systematic approach to spend analysis lies in its compound benefits. When you identify, cleanse, categorize, and analyze your spending data properly, you're not just saving money (though that's certainly nice). You're building cost reduction strategies that stick, gaining improved visibility into spending patterns you never knew existed, and creating risk mitigation plans by diversifying your supplier relationships and ensuring everyone follows the rules.

But here's where it gets really exciting: strategic sourcing becomes possible when you have clean, organized data. Instead of scrambling to find vendors when you need them, you can proactively build relationships with the right suppliers at the right terms.

Technology has completely transformed this process. What used to require armies of analysts with calculators and endless spreadsheets can now be handled by AI-powered tools that spot patterns, flag anomalies, and even predict future spending trends. These systems turn spend analysis from a quarterly headache into a real-time decision-making tool.

Here's something we've learned from years of helping companies optimize their spending: complex categories like corporate travel require specialized expertise. Travel expenses are notoriously difficult to analyze because they involve multiple vendors, last-minute changes, policy exceptions, and varying approval processes. That's where our experience in providing global business travel solutions really shines.

Our approach combines the speed and accuracy of modern spend analysis tools with the human touch that complex travel programs require. We understand that behind every expense report is a person trying to do their job effectively, and behind every policy is a finance team trying to control costs without stifling productivity.

When you partner with experts who understand both the technical side of spend analysis and the practical realities of business travel, you can streamline your analysis process and uncover savings opportunities that might otherwise stay hidden. Our comprehensive white-glove service means you get both the insights and the implementation support to turn those insights into real results.

The bottom line? Spend category analysis transforms businesses from reactive expense-trackers into proactive financial strategists. Instead of wondering where your money went, you'll know exactly where it's going and why that makes sense for your business goals.

Learn how we help CFO and Finance Executives optimize their financial strategies.