Why Corporate Travel Spend Matters More Than Ever

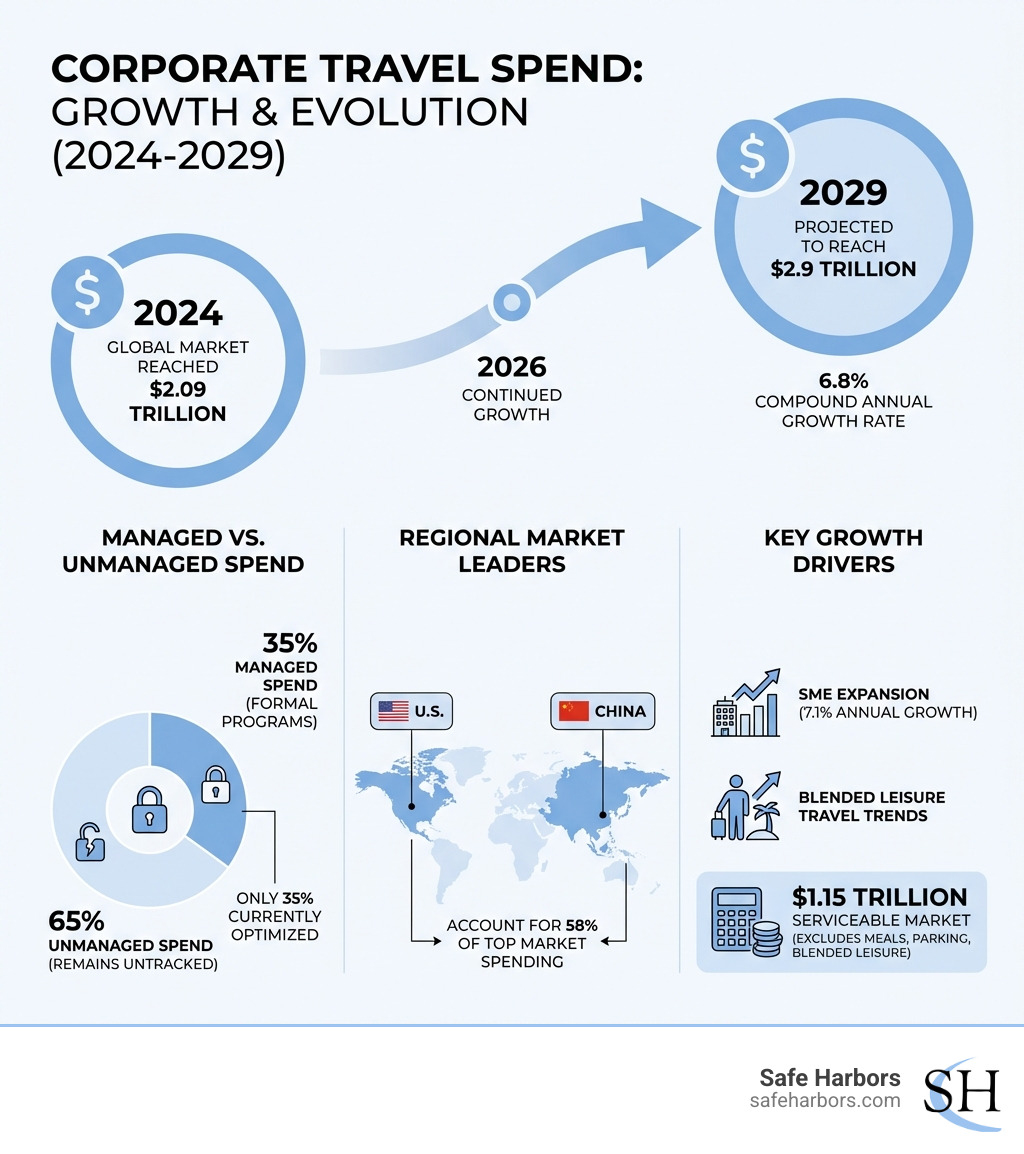

Corporate travel spend is entering a new era of strategic importance. After surpassing pre-pandemic levels in 2024 at $2.09 trillion globally, business travel is projected to reach $2.9 trillion by 2029—a compound annual growth rate of 6.8%. But these numbers tell only part of the story. Behind the growth lies a complex landscape where 65% of spending remains unmanaged, companies struggle to balance budget constraints with business needs, and travelers increasingly question the value of trips that don't meet their expectations.

Key Facts About Corporate Travel Spend:

- Global market reached $2.09 trillion in 2024, surpassing 2019 levels

- Projected to grow to $2.9 trillion by 2029 (6.8% annual growth)

- Only 35% of travel spend is currently managed through formal programs

- Companies with travel policy enforcement see 17-30% higher revenues

- Small and mid-sized businesses drive faster growth (7.1% annual rate)

- $1.15 trillion serviceable market excludes meals, parking, and blended leisure

- U.S. and China account for 58% of top market spending

The challenge isn't just about managing costs—it's about understanding where your money goes, why it matters, and how to maximize return on investment while keeping travelers safe and satisfied. As one travel manager put it: "Measuring the current moment in corporate travel simply based on growth, or by progress toward a post-pandemic normal, may oversimplify what’s unfolding."

As Jay Ellenby, President of Safe Harbors Travel Group, I've spent decades helping organizations steer the complexities of corporate travel spend through strategic management, innovative technology, and a relentless focus on traveler safety. In this guide, I'll show you what the data reveals about the future—and how to position your organization for success.

The Global Market Landscape: A Story of Growth and Complexity

The global business travel market is not just recovering; it's evolving. We're seeing a dynamic interplay of growth, regional shifts, and a redefinition of what constitutes valuable business travel. Understanding these nuances is crucial for any organization looking to optimize its corporate travel spend.

Understanding the Current State of Corporate Travel Spend

Our research shows that global corporate travel spend reached a significant $2.09 trillion in 2024, finally surpassing pre-pandemic levels. This robust recovery sets the stage for continued expansion, with projections indicating a leap to $2.9 trillion by 2029. This translates to a healthy compound annual growth rate (CAGR) of 6.8% through 2029.

However, this growth isn't uniform. Small and midsized companies (SMEs) are emerging as particularly strong drivers, with their corporate travel spend expected to grow at an even faster CAGR of 7.1%. This suggests that agility and the need for new market penetration are fueling travel among smaller enterprises.

While the overall numbers paint a positive picture, it's important to note that the real inflation-adjusted business travel spending remains approximately 14% below pre-pandemic levels. This highlights that while nominal spending is up, the purchasing power of those travel dollars has diminished.

Regionally, the landscape is shifting. The U.S. and China are ready to dominate, together representing 58% of the top 15 markets for business travel spending in 2025. Another leading industry forecast projects global business travel spending to reach $1.57 trillion USD in 2025, reflecting varying methodologies but a consistent upward trend. We also see that manufacturing continues to be a massive contributor, accounting for nearly one-third of global business travel spending. This sector's extensive supply chains and production needs necessitate frequent travel.

Total vs. Serviceable Market: What Can You Actually Manage?

When we talk about corporate travel spend, distinguish between the 'total addressable market' (TAM) and the 'serviceable addressable market' (SAM). The TAM encompasses all expenses related to business travel, regardless of how they're booked or managed. However, not all of this is directly manageable by traditional travel management companies (TMCs) or corporate policies.

The SAM, on the other hand, is the portion of corporate travel spend that can realistically be managed. It excludes expenses not typically bookable through travel providers, such as meals, parking, and the leisure portion of 'blended' trips where employees extend business travel for personal reasons. For 2024, the serviceable addressable market was estimated at $1.15 trillion, and it's expected to grow to $1.59 trillion by 2029.

This distinction is significant. While companies might be tracking all expenses, the ability to control and optimize them often lies within the SAM. The rise of blended leisure and business travel is also a notable trend. Spending in this category is projected to increase by a staggering 87% in the U.S. between 2024 and 2029. This presents both an opportunity for traveler satisfaction and a challenge for clear policy-making. For more detailed insights into managing these complexities, explore our More info about Corporate Travel Management services.

Key Influencers Shaping Corporate Travel Spend

The trajectory of corporate travel spend isn't just about economic recovery; it's intricately linked to a host of factors, from financial pressures to evolving corporate values. We're seeing a constant balancing act between cost and value, driven by strategic objectives and external forces.

Budget pressure, sustainability goals, and persistent economic uncertainty are fundamentally reshaping demand for business travel. Companies are no longer just asking "Can we afford this trip?" but "Is this trip essential? Does it align with our sustainability targets? What is the tangible ROI?" This strategic re-evaluation means that spending growth is occurring under selective and strategic conditions, particularly within large organizations. To steer this shifting landscape, understanding the latest insights is key, as highlighted in the Forecast in flux: 2025 Deloitte Corporate Travel Study.

The CFO Perspective: Balancing Budgets with Business Needs

CFOs play a pivotal role in shaping corporate travel spend. While many acknowledge the value of business travel, their perspective is often grounded in hard numbers and cost-benefit analysis. A significant 81% of CFOs agree that budget limitations at their company mean employees are unable to travel as much as needed to effectively perform their jobs. This indicates a tension between perceived need and allocated resources. Interestingly, 43% of CFOs also believe that over half of their company's business travel could be replaced by teleconferences, suggesting a continued skepticism about the necessity of all in-person meetings.

However, CFOs are also recognizing the direct link between travel investment and revenue. Our analysis, drawing from extensive research, reveals that a 1% increase in travel and expense (T&E) spending directly drives a 0.2% rise in company revenue. This causal relationship underscores that business travel isn't merely an expense but a revenue-generating investment. In fact, a modest 8% increase in T&E investment could boost overall sales by about 6%, generating up to $2.4 trillion in additional revenues across the aggregate market. This data empowers CFOs to view travel as a strategic tool rather than just a cost center. For more insights custom to financial leaders, visit our page for More info for CFO and Finance Executives.

The Employee View: The Perceived Value and Necessity of Travel

While CFOs focus on budgets, employees are on the front lines, and their perception of business travel is equally critical. The good news is that nearly all business travelers globally (97%) are at least somewhat willing to travel for business over the next 12 months. An overwhelming 94% say that business travel is either helpful (39%) or essential (55%) for them to be successful in their role. This clearly demonstrates that employees see travel as a vital component of their professional success.

Despite this willingness, employee concerns are significant and cannot be overlooked. Our surveys indicate that a substantial number of business travelers would consider declining a trip for various reasons. The top factors include:

- Safety or social concerns for traveling to certain parts of the world (40%)

- Health concerns related to traveling to a specific destination (38%)

- Feeling burnt out with travel and needing a break (26%)

Furthermore, 58% of business travelers express some concern about air travel safety, which, while not always deterring travel, adds to the mental load of frequent fliers. These concerns highlight the importance of robust duty of care programs and empathetic travel policies that prioritize traveler well-being.

Optimizing and Managing Travel Budgets for Maximum ROI

In this evolving landscape, effective management of corporate travel spend is paramount. It's about moving beyond simply cutting costs to strategically optimizing every dollar, leveraging technology, and ensuring policies are both efficient and traveler-centric.

The distinction between managed and unmanaged spend is particularly stark. As we noted, a significant 65% of global business travel spend is currently unmanaged, representing a vast untapped opportunity for control, savings, and improved traveler experience. This is where professional corporate travel management becomes indispensable. For a deeper dive into cost-saving strategies, explore our guide on More info about how to Reduce Business Travel Expenses.

Strategies to Optimize Your Corporate Travel Spend

Currently, only about 35% of total corporate travel spend is managed by companies with a dedicated travel management program or TMC. While North America boasts the highest percentage of managed travel, the Asia/Pacific region has the highest percentage of unmanaged travel, indicating regional variations in adoption. This 65% unmanaged spend means many companies are missing out on significant benefits.

The impact of disciplined policy enforcement is clear: companies with such enforcement significantly outperform those without, achieving 17–30% higher revenues. This isn't just about saving money; it's about enabling strategic travel that drives business growth. Our research also shows that companies with moderate or high travel management enforcement levels spend about 62% more on T&E than those with no enforcement. This counterintuitive finding often reflects that companies with more robust management systems also have greater business travel demand and a more structured approach to investing in it.

At Safe Harbors, we champion strategies that don't just cut costs but optimize the entire travel ecosystem. This includes revising travel policies to be clear and enforceable, implementing efficient approval workflows, adopting modern approaches to supplier negotiations, and leveraging advanced booking and fare forecasting technologies. We believe in achieving more with less, which is why we've put together More info about 7 Fundamental Ways Corporate Travel Management Saves Money.

The Role of Technology in Modern Expense Management

Technology is no longer a luxury but a necessity in managing corporate travel spend. The rapid advancements in artificial intelligence (AI) and automation are changing how expenses are tracked, approved, and analyzed. Generative AI, for instance, is ready to drive innovation, leading to faster, more streamlined, and personalized tools and processes. A promising 55% of CFOs expect AI to catch more errors and fraud than traditional methods, highlighting its potential for enhancing financial integrity.

Real-time spend controls are becoming standard. These systems, often integrated with corporate credit cards, can automatically block out-of-policy transactions, preventing overspending before it even occurs. This is a significant improvement over the traditional "pay and reclaim" model. Mobile payment solutions are also seeing widespread adoption, with 64% global mobile wallet usage. As Visa notes, "corporate travelers increasingly expect seamless, mobile-first payment experiences."

The risks associated with manual spend management processes are substantial. In 2023 alone, we saw a 17% increase in claims with missing receipts, a 29% increase in the amount of spend for these claims, and a 10% increase in expense reports with exceptions. These figures underscore the hidden costs and inefficiencies of manual systems. Implementing automated solutions, as discussed in our More info about Automated Spend Analysis, is crucial for mitigating these risks and gaining real-time visibility into spending patterns.

Key Expense Categories and Evolving Costs

Understanding where corporate travel spend goes is the first step to managing it effectively. Our analysis of Q1 2024 data reveals that the top expense categories were:

- Other/Miscellaneous: A whopping 32.04% of total spend. This broad category often hides a multitude of smaller, less trackable expenses.

- Air: 17.67%

- Lodging: 17.36%

What's particularly striking is how average transaction costs have evolved. Since 2019, the average transaction cost for 'Other' expenses has jumped by 57%, and 'Miscellaneous' by 47%. This suggests that the less defined categories are seeing significant price inflation or a shift in how expenses are classified. The average business trip now costs $1,128 USD, up from $834 in a 2024 survey, reflecting rising costs across the board.

This environment has led to what we call 'travelscrimping'—subtle cutbacks by companies that impact the traveler experience. Eighty-seven percent of business travelers report their company has cut back on previously allowed perks, such as staying overnight to avoid long day trips or using business/premium class. This can lead to traveler dissatisfaction, even though 85% of business travelers would spend their own money on perks to improve their trip if not covered by company policies. Conversely, 84% of travelers are also taking steps to save money, such as eating cheaper meals or using personal cards for rewards. For a deeper dive into expense categories, check out our More info about Spend Category Analysis.

Frequently Asked Questions about Corporate Travel Spend

What percentage of business travel spend is currently unmanaged?

Approximately 65% of global business travel spend is unmanaged, meaning it is not booked through a company-mandated tool or travel management company (TMC), presenting significant opportunities for cost savings and risk management. This figure varies regionally, with Asia/Pacific having the highest percentage of unmanaged travel, while North America leads in managed travel.

How does travel policy enforcement impact company revenue?

Research shows a direct correlation; companies with disciplined travel policy enforcement achieve 17–30% higher revenues than those without, demonstrating that strategic management is a revenue driver, not just a cost center. Furthermore, companies with moderate or high enforcement levels tend to have higher overall T&E spending, but this reflects their structured approach to investing in travel for business growth, rather than inefficiency.

What is 'travelscrimping' and how does it affect employees?

'Travelscrimping' refers to subtle company cutbacks on travel perks, such as no longer allowing overnight stays for long day trips, restricting business/premium class travel, or limiting blended travel options. 87% of travelers report experiencing this, which can negatively impact employee satisfaction, comfort, and productivity. Despite these cutbacks, 85% of travelers are willing to spend their own money on perks like higher-quality accommodations or additional hotel nights to improve their business travel experience.

Conclusion: Navigating the Future of Business Travel

The landscape of corporate travel spend is undeniably complex, marked by robust growth, economic volatility, and evolving traveler expectations. We've moved beyond a simple post-pandemic recovery into a period of strategic redefinition. The numbers clearly show that business travel is a vital investment for growth, directly impacting revenue and fostering essential human connections.

However, this growth comes with challenges: a significant portion of spend remains unmanaged, budget pressures are constant, and employee well-being and safety are paramount concerns. The future of corporate travel spend demands a nuanced approach that balances stringent cost control with maximizing value and ensuring a positive, productive experience for every traveler.

The future is managed travel—travel that is strategic, optimized, and empathetic. By partnering with a dedicated travel management expert like Safe Harbors, companies can steer market complexity, optimize spending, and ensure traveler safety and satisfaction, all while driving a clear return on investment. Our commitment to best response speed, comprehensive white-glove service, and innovative technology ensures that your corporate travel spend is not just managed, but transformed into a powerful engine for your business success. To learn more about how we can help safeguard your travelers and your investments, visit our page on More info about travel risk management.