Why Modern Organizations Are Embracing Automated Spend Analysis

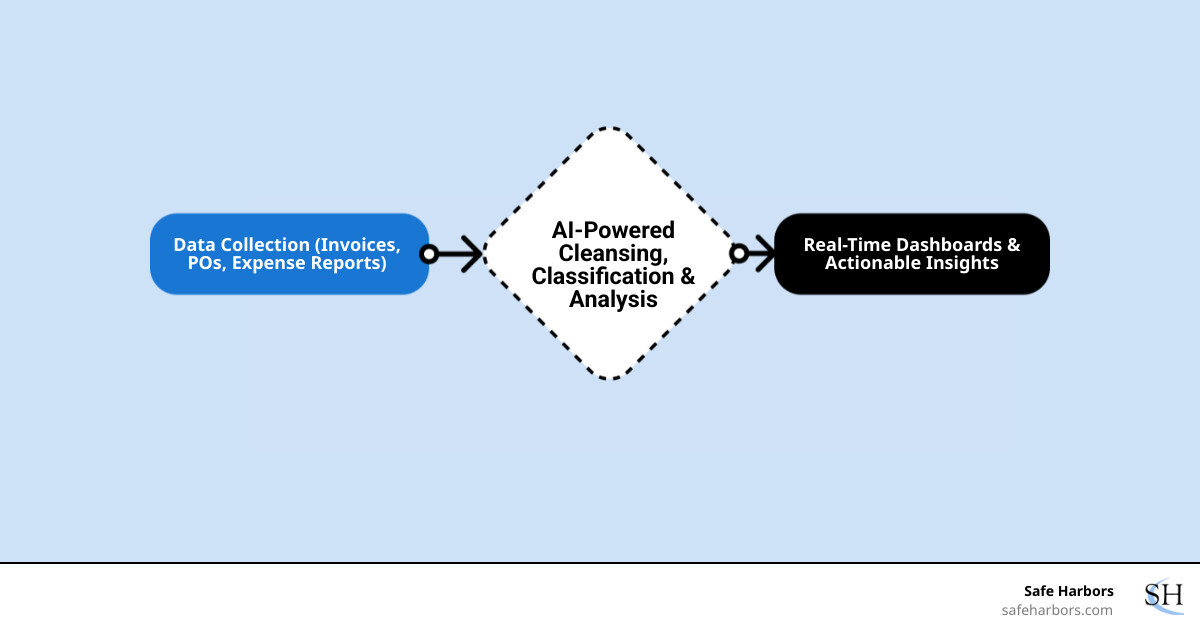

Automated spend analysis is an automatic digital process that captures, consolidates, and interprets spend data across an organization to provide insights into spending efficiency and effectiveness.

Key aspects of automated spend analysis:

- Process: Automatically collects data from invoices, purchase orders, and expense reports

- Technology: Uses AI and machine learning for data cleansing and categorization

- Output: Provides real-time dashboards and actionable insights for strategic decisions

- Benefits: Delivers up to 11% savings on annual spend while improving compliance and visibility

Manual spend analysis using spreadsheets and disparate systems simply can't keep pace. Procurement has evolved from a transactional function to a strategic one, with spend analysis software popularity projected to grow from $1.9 billion in 2021 to $5.4 billion by 2028 at a 16% annual growth rate.

The numbers are compelling. One manufacturing company identified $55 million in noncompliant purchase orders through automated analysis, while American Eagle Outfitters achieved an 80% target for PO compliance, translating into substantial savings. Meanwhile, 41% of business professionals see spend data analysis as their biggest priority for improving spend management practices.

For corporate travel managers especially, understanding spend patterns is crucial for controlling costs, ensuring policy compliance, and demonstrating value to finance teams. The days of manual tracking using disparate systems are giving way to an era where automated spend analysis drives strategic, high-impact procurement operations.

What is Spend Analysis and Why Automate It?

Imagine tracking every dollar your company spends with scattered spreadsheets. That's what traditional spend analysis looked like – and it was as ineffective as it sounds.

Automated spend analysis is the process of collecting, organizing, and examining your company's spending data using smart technology instead of manual grunt work. Think of it as having a financial detective that never sleeps, constantly piecing together clues about where your money goes and how you can spend it better.

The old way of doing this was painful. Finance teams would spend weeks gathering invoices from different departments, trying to make sense of purchase orders that didn't match receipts, and attempting to categorize expenses that seemed to defy all logic. The result? Inaccurate data, missed opportunities, and a lot of frustrated employees.

But here's the exciting part: the automated spend analysis market is projected to explode from $1.9 billion in 2021 to $5.4 billion by 2028. That's a 16% annual growth rate, which tells us this isn't just a passing trend – it's become strategically essential for modern businesses.

The difference between manual and automated approaches is like comparing a horse and buggy to a sports car:

| Feature | Manual Spend Analysis | Automated Spend Analysis |

|---|---|---|

| Speed | Slow, weeks to months | Fast, real-time to daily |

| Accuracy | Prone to human error, inconsistent | High, AI-driven consistency |

| Scalability | Limited, struggles with large data | High, handles vast data volumes |

| Insight Gen. | Basic, reactive | Advanced, predictive, proactive |

The Problem with Traditional Spend Analysis

Let's be honest about what manual spend analysis really looked like. Picture this: your procurement team has their spreadsheets, finance has theirs, and each department is tracking expenses their own way. Nobody's talking to each other, and the data rarely matches up.

Data silos were everywhere. One department might categorize "office supplies" completely differently than another, making it impossible to see the big picture. Meanwhile, human error crept into every step – typos in data entry, duplicate entries, and miscategorizations that made the final reports about as reliable as weather forecasts.

The worst part? This approach was purely reactive. By the time you realized you were overspending on something, the damage was already done. Hidden opportunities for savings stayed hidden, and inefficient processes continued draining resources. According to our research, 28% of professionals struggle with spend management because their software simply doesn't work effectively.

The Shift to Automation: A Strategic Necessity

The move toward automated spend analysis isn't just about making life easier – though it certainly does that. It's become a competitive necessity that's caught the attention of C-suite executives everywhere.

Why? Because automation transforms spend analysis from a backward-looking chore into a forward-thinking strategic tool. Instead of waiting weeks for reports that tell you what already happened, you get real-time intelligence that helps you make smarter decisions right now.

This improved decision-making capability is especially crucial for companies managing complex spending categories. Take corporate travel, for example – it's one of the most challenging areas to control because expenses come from everywhere and can vary wildly. Understanding these patterns can reveal surprising insights about where costs might be higher than expected, which is why we've written extensively about managing travel expenses.

The bottom line? Automated spend analysis has evolved from a nice-to-have tool to a strategic imperative. Companies that accept it gain unprecedented visibility into their spending, uncover savings opportunities they never knew existed, and make more informed decisions that drive real business results.

The Core Process: How Automated Spend Analysis Works

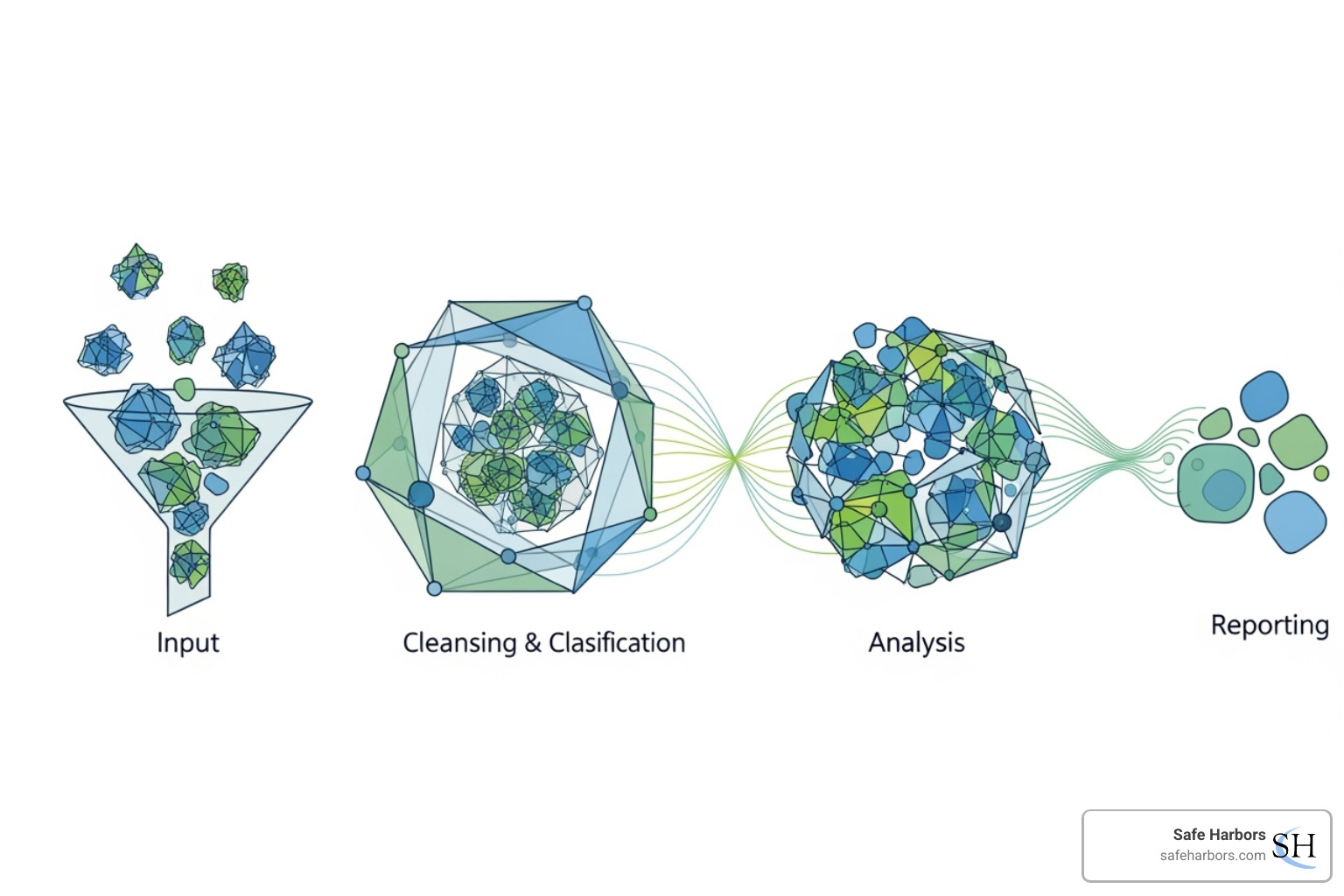

Think of automated spend analysis as your organization's financial detective. It doesn't just crunch numbers – it tells a story about where your money goes, why it goes there, and how you can make smarter decisions. The process unfolds in four key stages that transform messy data into crystal-clear insights.

Step 1: Data Collection and Consolidation

Picture trying to solve a puzzle when the pieces are scattered across different rooms, in different boxes, some upside down. That's what spend data looks like before automation steps in. Your invoices live in one system, purchase orders in another, and expense reports somewhere else entirely.

Automated spend analysis starts by becoming a master gatherer. It pulls data from everywhere – invoices, purchase orders, expense reports, payment records, and contract details. The real magic happens when it connects with your enterprise resource planning (ERP) system, which acts like the central nervous system of your business operations.

But here's where it gets impressive. Instead of having someone manually type in data from paper receipts (we've all been there), the system uses OCR technology to read documents like a human would. It scans invoices, extracts the important details, and converts everything into digital format. No more squinting at blurry receipts or deciphering handwritten notes.

All this scattered information gets funneled into one central location, creating a single source of truth for your spending data. It's like finally having all those puzzle pieces in one box, right-side up and ready to work with.

Step 2: Data Cleansing and Classification

Now comes the part that would make any perfectionist happy. Raw data is messy – really messy. You might have "IBM," "International Business Machines," and "I.B.M." all referring to the same supplier. Currency formats are inconsistent, and don't even get us started on duplicate entries.

This is where automated spend analysis puts on its janitor hat and gets to work. Data normalization standardizes everything – supplier names, currencies, units of measure – so your system speaks one language instead of dozens.

The system becomes a detective, hunting down and eliminating duplicate entries that could skew your analysis. But the real star of this show is AI-powered categorization. Using machine learning, the system learns to classify transactions into the right buckets automatically. Office supplies go in one category, IT services in another, travel expenses in theirs.

Data enrichment adds another layer of intelligence. The system might find that three different supplier names actually belong to the same parent company. This supplier parent-child linking gives you a true picture of how much you're really spending with each corporate family. Suddenly, you realize you have more negotiating power than you thought.

Step 3: Analysis and Insight Generation

Here's where your clean, organized data transforms into something truly valuable – insights that can save your company serious money. The system starts identifying trends over time, showing you patterns you never would have spotted manually.

Anomaly detection becomes your financial watchdog, alerting you to unusual spending spikes or suspicious transactions. Maybe someone's making purchases outside your normal procurement process – that's maverick spend, and it can add up fast. Manufacturing company that found $55 million in non-compliant purchase orders? That's the power of automated detection at work.

The system doesn't just find problems – it uncovers savings opportunities hiding in plain sight. It might spot chances for supplier consolidation, identify contracts ready for renegotiation, or reveal volume discount opportunities you're missing.

Automated spend analysis answers the questions that keep finance teams up at night:

- What are we buying? Get a clear picture of your spending categories

- Who are we buying from? Understand your supplier relationships

- Are we getting the best price? Compare costs and identify negotiation opportunities

- Where can we save money? Spot consolidation and efficiency opportunities

- Are we following our own rules? Track policy compliance and contract adherence

These aren't just reports – they're roadmaps to better financial performance. When you can see exactly where every dollar goes, you can make decisions that actually move the needle on your bottom line.

Key Benefits of Implementing Automated Spend Analysis

When you implement automated spend analysis, you're not just organizing your financial data—you're open uping a change that touches every corner of your organization. The ripple effects are remarkable: substantial cost reduction, smoother operations, better risk management, and a truly strategic approach to procurement. Organizations using dedicated spend analysis software often see savings of up to 11% of their annual spend. That's not pocket change; that's changeal.

At Safe Harbors, we understand this change intimately. Managing corporate travel spend requires the same strategic thinking and visibility that automated analysis provides across all spending categories. Our experience shows how powerful strategic management can be, which you can explore in our guide to 7 Fundamental Ways Corporate Travel Management Saves Money.

Gain Unprecedented Spend Visibility and Control

Picture this: instead of hunting through multiple spreadsheets and systems to understand your spending, you have a centralized dashboard that shows everything in real-time. Every department, every category, every supplier—all visible at a glance. This isn't just convenient; it's for how you manage your organization's financial health.

This crystal-clear visibility immediately translates into better control over your spending. Take Purchase Order compliance, for example. Automated spend analysis can track exactly when purchases bypass your established procedures. American Eagle Outfitters consistently hit their 80% target for PO compliance, and those numbers translated directly into substantial savings. We've seen a manufacturing company identify $55 million in noncompliant POs and track 691 transactions worth $47 million—all because automated systems caught what manual processes missed.

For finance teams and travel managers, this level of oversight is a game-changer. You can enforce policies, reduce maverick spending, and ensure every dollar serves a strategic purpose. It's about bridging that often tricky gap between financial objectives and operational needs, something we explore in depth in The Business Travel Manager's Dilemma: Keeping Finance and Your Travelers Happy.

Drive Significant Cost Savings and Improve Cash Flow

Let's talk about the bottom line—because that's often what drives the decision to implement automated spend analysis in the first place. The cost savings potential is genuinely impressive. When you consolidate your spend data and apply advanced analytics, you suddenly see opportunities for supplier consolidation that weren't obvious before. Fewer vendors often means better bulk discounts and stronger negotiating positions.

Speaking of negotiations, having comprehensive spend data gives you serious leverage when it's time to renegotiate contracts. You're not guessing about your spending patterns anymore; you have concrete data showing exactly what you buy, when, and from whom. This knowledge is power at the negotiating table.

The system also highlights opportunities for early payment discounts that might otherwise slip through the cracks. These small percentages add up to substantial savings over time. Our research shows organizations can realize savings of up to 11% of their annual spend—a figure that can transform your financial performance.

Beyond direct cost reduction, automated analysis dramatically improves your cash flow forecasting. When you have a real-time, accurate picture of your payables and future spending commitments, your finance team can make much more precise cash flow predictions. This means better working capital optimization and greater financial stability overall.

Improve Strategic Sourcing and Supplier Management

Here's where automated spend analysis really shines: it lifts procurement from a transactional function to a truly strategic one. Instead of just processing purchase orders, you're making informed decisions about supplier performance, pricing trends, and overall value delivery.

Supplier rationalization becomes a data-driven process rather than a cost-cutting exercise. You can see exactly how much you spend with each vendor, identify consolidation opportunities that make sense, and strengthen relationships with your most valuable partners. This reduces administrative overhead while building more strategic partnerships.

The risk management benefits are equally compelling. Automated analysis helps you spot supply chain vulnerabilities—like over-reliance on a single supplier—before they become problems. You can build resilience into your supply chain based on actual data rather than assumptions.

This strategic approach to supplier relationships creates lasting value. When you understand your spending patterns and supplier performance at this level, you can build partnerships that deliver consistent value over time. For more insights on how strategic management approaches create broader business benefits, check out 5 More Benefits of Corporate Travel Management.

Tools and Technologies Powering Modern Spend Analysis

The world of automated spend analysis is powered by a fascinating ecosystem of tools and technologies that work together like a well-orchestrated symphony. Each component plays its part in changing your scattered spend data into clear, actionable insights that can drive real business value.

Key Types of Software and Tools

Many organizations start their spend analysis journey with what they already have: their Enterprise Resource Planning (ERP) systems. These workhorses of the business world, like SAP and Oracle, were designed to handle the day-to-day operations across finance, procurement, and other key functions. While ERPs often include basic spend analysis modules, they're like Swiss Army knives – good at many things but not necessarily the best tool for every specific job.

That's where dedicated standalone spend analysis software steps in to save the day. These specialized solutions are built from the ground up with one mission: to make sense of your spending data. They excel at automatically collecting data from multiple sources, cleaning it up with sophisticated algorithms, and presenting it through customizable dashboards. Think of them as the difference between using a basic camera phone versus a professional photography setup – both can take pictures, but one delivers dramatically better results.

The final piece of this technology puzzle is Business Intelligence (BI) tools, which are absolute game-changers for data visualization. Microsoft Power BI and similar platforms take complex spend data and transform it into beautiful, easy-to-understand charts and interactive dashboards. As Phil Simon, author of The Visual Organization, points out, using BI tools for data visualization is no longer an unattainable goal – it's become accessible to everyone, including procurement teams who need to present their findings clearly and effectively.

You can see this power in action through this Microsoft.com Example of a IT spend analysis dashboard, which shows how complex IT spending patterns can be made instantly understandable through smart visualization. When these BI tools work alongside your ERP or dedicated spend analysis software, you get real-time insights that make spotting trends and opportunities feel almost effortless.

The Transformative Role of AI in Automated Spend Analysis

Here's where things get really exciting: Artificial Intelligence isn't just changing spend analysis – it's completely revolutionizing it. AI, particularly machine learning, is like having a brilliant analyst who never sleeps, never makes mistakes, and gets smarter with every piece of data processed.

The magic starts with automated data cleansing and categorization. AI algorithms can spot inconsistencies in vendor names (like "IBM" versus "International Business Machines"), eliminate duplicate entries, and standardize formats faster and more accurately than any human team. These systems learn from patterns to correctly categorize even the most complex or ambiguous spend descriptions, turning what used to be weeks of manual work into minutes of automated processing.

Predictive analytics moves us from simply looking backward to actually seeing into the future. By analyzing historical spending patterns, AI can forecast upcoming expenditures with remarkable accuracy. This means better budgeting, fewer surprises, and the ability to plan strategically rather than just react to what's already happened.

Anomaly detection is where AI really flexes its muscles. These systems are incredibly good at spotting unusual spending patterns that might indicate maverick purchases, policy violations, or even fraudulent activity. It's like having a financial detective that never misses a clue, constantly scanning for anything that doesn't fit the normal pattern.

Natural Language Processing (NLP) allows systems to read and understand unstructured text from invoices, contracts, and emails. This means valuable insights hidden in written communications can finally be captured and analyzed, opening up entirely new sources of intelligence about your spending patterns.

Perhaps most impressively, AI-driven recommendations can actually suggest specific cost-saving opportunities and optimal supplier choices based on your unique spend data and current market conditions. It's like having a virtual procurement consultant that's always looking for ways to help you optimize and save money.

The beauty of AI integration is that your automated spend analysis becomes truly intelligent – constantly learning, adapting, and improving to deliver increasingly accurate and actionable insights that drive real business value.

Implementation: Challenges and Best Practices

Starting on the journey of automated spend analysis is exciting, but let's be honest – it's not always smooth sailing. Like learning to ride a bike, there might be a few wobbles along the way. The good news? With the right approach and mindset, these challenges become manageable stepping stones to success.

Think of implementation as building a house. You wouldn't start with the roof, right? The same principle applies here. For organizations looking to make similar strategic transitions, many of these lessons mirror what we see in other areas of business change. Our Your 6-Step Guide to Making the Move to Managed Travel offers a similar roadmap that many find helpful.

Common Challenges to Anticipate

The biggest hurdle most organizations face? Poor data quality. It's like trying to make a gourmet meal with ingredients that have been sitting in your pantry for years – the results won't be pretty. Incomplete records, inconsistent supplier names, and missing transaction details can throw even the most sophisticated system off track.

Then there's the reality of fragmented systems. Your procurement data might live in one system, accounting in another, and travel expenses in yet another. Getting them to talk to each other can feel like mediating a family dinner conversation – possible, but requiring patience and skill.

Resistance to change is another common challenge. It's natural for people to worry about new technology. Will it replace them? Will they need to learn completely new skills? These concerns are valid and need addressing with empathy and clear communication.

The statistics tell us that 28% of surveyed professionals stated that ineffective software makes spend management difficult. This highlights why choosing the right solution matters so much. The wrong tool can create more problems than it solves, turning what should be a streamlined process into a daily frustration.

Finally, many organizations jump in without defining clear objectives. Without knowing what success looks like, how can you measure whether you've achieved it? This lack of direction can lead to solutions that look impressive but don't actually solve your specific challenges.

Best Practices for a Successful Rollout

Success in implementing automated spend analysis comes down to taking a thoughtful, step-by-step approach. Think of it as building momentum rather than trying to move mountains overnight.

Start with a pilot project – this is perhaps the most important advice we can give. Pick one department or spend category and prove the concept there first. Maybe begin with office supplies or IT expenses. This approach lets you work out the kinks, show early wins, and build internal champions who can help spread enthusiasm throughout the organization.

Data governance isn't the most exciting topic, but it's absolutely critical. As Steve Farr of TIBCO Software wisely notes, "Don't make the mistake of forgetting about data governance when selecting your business intelligence solution." Establish clear rules about how data gets collected, entered, and maintained. Clean data in means reliable insights out.

Involve key stakeholders from day one. Your procurement team knows the pain points, finance understands the reporting needs, and IT knows what systems you're working with. Getting their input early prevents expensive course corrections later.

Comprehensive training makes the difference between adoption and abandonment. People need to feel confident using the new system. Invest in proper training sessions, create user guides, and establish support channels for when questions arise.

Measure ROI continuously to keep everyone motivated and on track. Track cost savings, time efficiencies, and compliance improvements. These metrics not only justify your investment but also highlight areas for further improvement.

Choosing the right partner is crucial for success. The same principles that apply to selecting any business partner – expertise, responsiveness, and cultural fit – matter here too. Consider the insights from 10 Factors to Consider When Searching for the Right Travel Management Partner, as many of these evaluation criteria apply directly to spend analysis solutions.

Implementation isn't a destination – it's the beginning of a journey toward more strategic, data-driven procurement decisions.

Conclusion

Automated spend analysis replaces error-prone spreadsheets with AI-driven visibility and control. It turns chaotic data into real-time insights that power proactive decisions and strategic procurement.

Organizations routinely realize up to 11% annual savings, tighter compliance, and better cash-flow forecasting, while uncovering noncompliant spend and improving PO adherence.

The future of procurement is here: intelligent automation, real-time data, and a culture where every dollar serves a purpose.

At Safe Harbors, travel spend is a major category. Our integrated solutions deliver the clean, categorized data finance leaders need to govern, forecast, and optimize travel costs while supporting business goals.

Ready to see the impact? Learn how we help CFO and Finance Executives gain control over travel spend.