Why Every Organization Needs a Risk Mitigation Strategy

A risk mitigation strategy is a structured plan to reduce the likelihood and impact of potential threats to your business. It involves identifying risks, assessing their severity, and implementing specific actions to minimize their negative effects on your operations, finances, and people.

The four core risk mitigation strategies are:

- Avoidance - Eliminating risk by avoiding the activity entirely

- Reduction - Implementing controls to lower probability or impact

- Transfer - Shifting risk to third parties through insurance or contracts

- Acceptance - Acknowledging risk when mitigation costs exceed potential losses

As Benjamin Franklin once said, "If you fail to plan, you are planning to fail." This wisdom rings especially true in today's unpredictable business environment, where organizations face an ever-expanding array of threats.

The numbers tell a compelling story. Organizations that prioritize risk management are 2.5 times more likely to achieve their financial goals, while companies with mature risk management programs are 30% more likely to outperform their peers. With 88% of companies believing risk management is essential for business success, having a structured approach isn't just smart - it's critical for survival.

For corporate travel managers, the stakes are particularly high. You're responsible for employee safety across multiple time zones, dealing with everything from natural disasters to geopolitical instability. A single incident can expose your organization to significant liability, not to mention the human cost of putting employees at risk.

The good news? Risk mitigation doesn't have to be overwhelming. With the right framework and tools, you can build a robust strategy that protects your people, preserves your reputation, and keeps your business running smoothly even when the unexpected happens.

What is Risk Mitigation and Why Is It Crucial?

Before we dive into building your strategy, let's get clear on what we're actually talking about. You've probably heard "risk management" and "risk mitigation" used like they're the same thing, but they're actually close cousins with different jobs.

Think of risk management as the big picture process. It's everything from spotting potential problems to figuring out how serious they might be. These fundamentals will help you build a robust risk management plan that covers all your bases.

Risk mitigation, on the other hand, is where the rubber meets the road. It's the specific actions you take to actually reduce those risks. If risk management asks "What could go wrong?", then risk mitigation asks "What are we going to do about it?"

| Feature | Risk Management | Risk Mitigation |

|---|---|---|

| Scope | Broad; encompasses identification, assessment, prioritization, and treatment of all risks. | Specific; focuses on developing and implementing strategies to reduce the impact or likelihood of identified risks. |

| Goal | Understand and control all threats to an organization's capital, earnings, and operations. | Minimize the negative effects of specific risks. |

| Process | Continuous cycle of identifying, analyzing, planning responses, and monitoring. | Action-oriented; involves selecting and executing specific strategies (avoidance, reduction, transfer, acceptance). |

| Output | A comprehensive risk profile, risk register, and overall risk appetite. | Action plans, controls, insurance policies, contingency plans. |

Here's why this matters: a solid risk mitigation strategy isn't about eliminating every possible risk. That's usually impossible and often too expensive. Instead, it's about getting risks down to a level you can live with while keeping your business running smoothly.

When you do this right, you're not just protecting your assets. You're building business resilience that gives stakeholders confidence and creates a real competitive advantage. It's a core part of what we call Business Travel Duty of Care and Risk Management, especially when your team is spread across the globe.

Common Types of Business Risks

Every business faces different flavors of risk. Understanding the main categories helps you prepare for what might come your way.

Operational risks are the day-to-day challenges that can trip you up. We're talking about system failures, human errors, supply chain hiccups, or that unexpected storm that shuts down your main facility.

Financial risks hit where it hurts most - your bottom line. Market swings, currency changes, economic downturns, or cash flow crunches all fall into this bucket.

Strategic risks threaten your long-term game plan. Maybe customer tastes shift, new competitors emerge, or technology makes your product obsolete overnight.

Compliance risks come from failing to follow the rules. Whether it's industry regulations, labor laws, or internal policies, getting this wrong can mean hefty fines and legal headaches.

Reputational risks can destroy years of trust in minutes. Product recalls, ethical scandals, or even a poorly handled customer complaint that goes viral can damage your brand.

Cybersecurity risks are everywhere these days. Data breaches, ransomware, and other digital threats can shut you down and expose sensitive information.

Supply chain disruptions can stop your business cold. When key suppliers can't deliver, whether due to natural disasters, political issues, or other problems, your operations suffer.

The Undeniable Impact of Risk

The numbers don't lie - ignoring risk is expensive. The average data breach now costs companies $4.35 million. That's not just IT costs; it includes lost business, legal fees, and reputation repair.

Supply chain problems are just as brutal. More than 60% of businesses have dealt with major supply chain disruptions in recent years. When your suppliers can't deliver, you're looking at production delays, missed deadlines, and frustrated customers.

Think of risks like dominoes lined up in a row. When one falls, it can knock down everything else in your business. A single unmitigated risk doesn't just cost money - it can damage employee morale, hurt productivity, and threaten your company's future.

That's exactly why a proactive risk mitigation strategy isn't optional anymore. It's the difference between businesses that thrive through uncertainty and those that struggle to survive it.

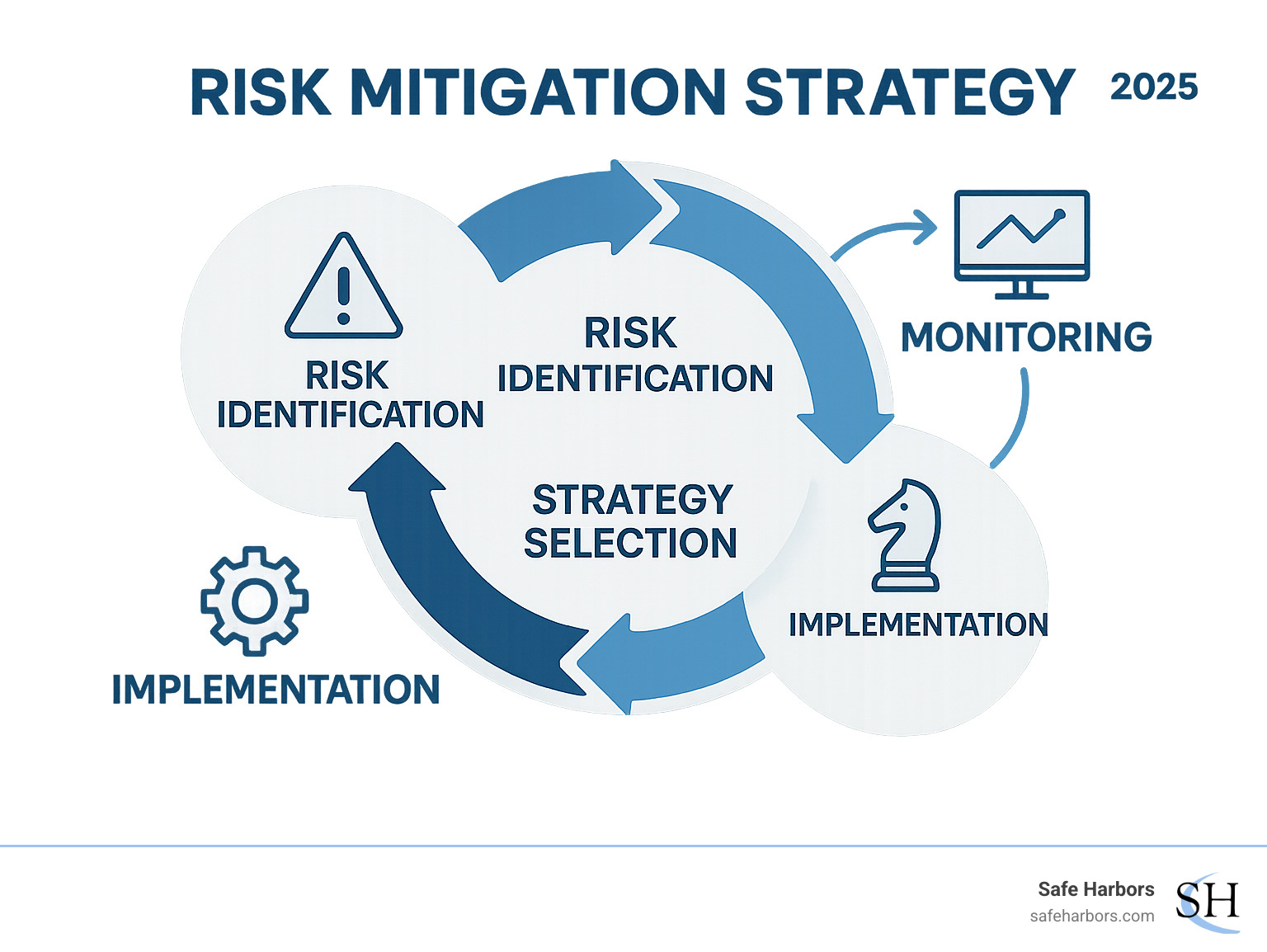

A 5-Step Process for Building Your Risk Mitigation Strategy

Creating an effective risk mitigation strategy isn't something you do once and forget about. It's more like tending a garden – it needs regular attention, the right tools, and input from everyone who cares about the outcome.

The best strategies emerge when project managers work hand-in-hand with stakeholders across every department. This collaborative approach builds something invaluable: a genuine risk-aware culture where spotting potential problems becomes everyone's responsibility, not just management's headache.

Think of it as creating a company-wide early warning system. When your accounting team notices unusual payment delays, your IT department spots suspicious network activity, or your travel coordinator hears about political unrest in a key destination, they all know these observations matter. This collective vigilance transforms your entire organization into a risk detection powerhouse.

Step 1: Identify and Assess Potential Risks

This detective work phase requires both systematic thinking and creative brainstorming. You're essentially asking, "What could possibly go wrong?" – but in the most productive way possible.

Start with brainstorming sessions that bring together people from different departments. The magic happens when your finance person mentions cash flow concerns while your operations manager talks about supplier reliability. Suddenly, you're seeing connections and potential cascading effects that might never surface in isolated thinking.

A SWOT analysis provides another lens for risk findy. Your identified weaknesses often reveal internal vulnerabilities, while external threats highlight market and environmental risks. Don't skip the historical data review either – past incidents and near-misses are treasure troves of insight about what could happen again.

The risk assessment matrix becomes your best friend during this phase. Plot each identified risk based on two key dimensions: likelihood (how probable is this?) and impact (how much would this hurt?). This visual approach makes prioritization crystal clear. High likelihood, high impact risks demand immediate attention, while low likelihood, low impact risks might simply need monitoring.

"By identifying and prioritizing risks, you can allocate resources and develop targeted mitigation strategies" effectively. For organizations managing corporate travel, this systematic approach reveals "Why Implementing a Travel Risk Plan for Employees is Crucial" for protecting both people and business operations.

Step 2: Choose from the Four Core Risk Mitigation Strategies

Once you understand your risk landscape, you face a crucial decision: what to do about each threat. Your choice depends on your risk appetite (how much uncertainty you're comfortable with), cost-benefit analysis, and the specific nature of each risk. "Project managers play a crucial role in this process" by guiding these strategic decisions for their specific initiatives.

Avoidance means eliminating the risk entirely by not engaging in the risky activity. If a particular travel destination poses severe security threats, you might decide not to send employees there at all. It's the most straightforward approach, but it can mean missing valuable opportunities.

Reduction focuses on lowering either the likelihood or impact of risks you can't avoid. This might mean implementing stronger cybersecurity protocols, conducting regular safety training, or diversifying your supplier base. You're not eliminating the risk, but you're making it much more manageable.

Transfer shifts the risk burden to someone better equipped to handle it. Insurance is the classic example – you pay premiums to transfer financial risk to an insurer. Outsourcing risky activities to specialized vendors or including penalty clauses in contracts are other common transfer strategies.

Acceptance involves acknowledging a risk and deciding to live with it. This makes sense when the potential impact is minimal, the likelihood is extremely low, or mitigation costs would exceed potential losses. You're not ignoring the risk – you're making a conscious business decision that it's not worth additional investment.

Step 3: Develop and Implement Your Risk Mitigation Plan

Now comes the rubber-meets-the-road phase. Your mitigation plan transforms good intentions into concrete actions with clear accountability.

Break each strategy into specific action items with realistic timelines and crystal-clear responsibilities. Nobody should wonder who's supposed to do what by when. Define success metrics upfront – how will you know if your efforts are working? These might be key performance indicators or specific risk reduction targets.

Your communication plan ensures everyone understands not just their role, but why it matters. When people understand how their piece fits into the bigger picture, they're much more likely to follow through effectively.

Don't forget contingency planning. Even the best mitigation efforts can't prevent every risk from materializing. Having a "Plan B" ready means you can respond quickly and effectively when something does go wrong.

"Incorporating risk mitigation into your strategy is a comprehensive process" that weaves protection into your daily operations. For travel-focused organizations, this integration ensures "The Compelling Security Benefits of Corporate Travel Management" become reality rather than just good intentions.

Step 4: Monitor, Review, and Report on Risks

Your risk mitigation strategy needs constant attention to stay effective. The business world changes rapidly, and yesterday's minor concern can become tomorrow's major threat.

Key Risk Indicators (KRIs) act like your risk dashboard. For cybersecurity, you might track failed login attempts or suspicious network activity. For supply chain risks, you might monitor delivery delays or supplier financial health. These metrics help you spot problems before they become crises.

Schedule regular reviews at appropriate intervals – weekly for project-specific risks, quarterly for departmental concerns, annually for enterprise-wide threats. Independent audits provide valuable outside perspective on whether your controls actually work as intended.

Stakeholder reporting keeps leadership informed and engaged. Regular updates on risk status and mitigation progress maintain accountability and ensure continued support for your efforts.

Most importantly, stay flexible. Adapting your plan based on new information, changing circumstances, or lessons learned keeps your strategy relevant and effective. When crisis strikes, your "Immediate Response" capabilities depend directly on how well you've monitored and evolved your risk management approach.

Real-World Examples of Effective Risk Mitigation

Sometimes the best way to understand risk mitigation strategy is to see it in action. Let's explore how smart organizations have turned potential disasters into manageable challenges through thoughtful planning and quick action.

Take the manufacturing company that learned the hard way about putting all their eggs in one basket. When their single supplier's factory burned down, production ground to a halt for weeks. Their solution? Supply chain diversification. Now they source critical components from at least two different suppliers in separate geographical regions. It costs a bit more upfront, but they sleep better knowing one factory fire won't shut down their entire operation.

Then there's the technology company that took cybersecurity seriously after seeing too many headlines about data breaches. With the average breach costing $4.35 million, they knew they couldn't afford to be reactive. They implemented a multi-layered cybersecurity strategy that includes regular system updates, mandatory multi-factor authentication, ongoing employee training, and advanced threat detection software. It's a perfect example of risk reduction through smart investment.

Financial risks get creative solutions too. A multinational corporation we know uses currency forward contracts to protect against exchange rate fluctuations. Instead of watching their profits swing wildly with currency markets, they transfer that risk to financial institutions through hedging instruments. Their finance team can focus on running the business instead of playing currency roulette.

Example: Mitigating Corporate Travel Risks

At Safe Harbors, mitigating corporate travel risks isn't just what we do—it's why we exist. Every day, we help organizations steer the complex world of business travel while keeping their people safe and their legal obligations met.

Duty of care forms the foundation of everything we do. It's not just a legal requirement; it's our moral compass. When companies send employees around the world, they're responsible for their safety and well-being. That responsibility doesn't end when the plane takes off—it intensifies.

Our traveler tracking and communication systems ensure we always know where people are and can reach them instantly. During a crisis, those precious minutes matter. Whether it's a natural disaster, political unrest, or a global pandemic, we can quickly identify who's in the affected area and establish direct contact. We learned this lesson during COVID-19, when some organizations struggled to locate their travelers as borders slammed shut worldwide.

Pre-travel briefings are where prevention meets preparation. Before any significant trip, especially to high-risk destinations, we provide comprehensive briefings covering security conditions, local customs, health concerns, and emergency contacts. It's amazing how much trouble you can avoid by simply knowing what to expect and how to respond.

When it comes to natural disasters, we don't just hope for the best—we prepare for the worst. Our protocols cover everything from hurricanes to earthquakes, and we've even compiled practical advice like "Six Tips for Prepping for a Natural Disaster While Away on Business." These plans include re-routing options, evacuation procedures, and ensuring travelers have access to emergency funds when they need them most.

Geopolitical instability and health crises require constant vigilance and flexible responses. From civil unrest to disease outbreaks like the "Coronavirus" pandemic, we continuously monitor global events and adjust our recommendations accordingly. Our risk mitigation strategy blends all four approaches: avoiding truly dangerous areas when possible, reducing risks through education and precautions, transferring certain risks through insurance and partnerships, and accepting unavoidable risks when business-critical travel must continue.

The key is having systems in place before you need them. When crisis strikes, it's too late to start building your response plan.

Tools and Technologies to Improve Your Risk Mitigation Efforts

The right technology can transform your risk mitigation strategy from a manual, reactive process into a proactive, intelligent system that works around the clock to protect your business.

Think of these tools as your early warning system. Just like weather satellites help meteorologists predict storms days in advance, modern risk management technology helps you spot potential problems before they become full-blown crises.

Risk assessment software has revolutionized how we identify and analyze threats. These platforms take the guesswork out of risk evaluation by providing structured templates for risk registers, automated probability-impact matrices, and intuitive reporting dashboards. Instead of relying on spreadsheets and gut feelings, you get data-driven insights that help you make smarter decisions about where to focus your efforts.

GRC (Governance, Risk, and Compliance) platforms take things a step further by creating a unified view of your entire risk landscape. These integrated solutions centralize all your risk data and workflows in one place, making it easier to ensure compliance with regulations while maintaining strong governance. It's like having a mission control center for your entire risk mitigation strategy.

The real game-changer, however, is data analytics. By using big data and advanced analytics, you can identify patterns and predict potential risks before they materialize. This shift from reactive to proactive risk management is like the difference between fighting fires and preventing them from starting in the first place.

When crisis strikes, communication tools become your lifeline. Incident response platforms, mass notification systems, and secure messaging apps ensure you can reach employees instantly, no matter where they are in the world. Clear, rapid communication can mean the difference between a minor incident and a major catastrophe.

For organizations managing corporate travel, travel risk management platforms are absolutely essential. These specialized tools offer real-time traveler tracking, automated alerts for incidents like severe weather or security threats, and two-way communication capabilities that fulfill your duty of care obligations.

"The Mitre website offers comprehensive guidelines for risk mitigation" that can be adapted across various contexts, including travel risk management. For organizations involved in "Humanitarian Travel", these technological solutions become even more critical given the unique complexities and liftd risks associated with these missions.

The beauty of modern risk management technology is that it doesn't just help you respond faster – it helps you respond smarter. With the right tools in place, you're not just protecting your business; you're building a competitive advantage that allows you to operate confidently in an uncertain world.

Frequently Asked Questions about Risk Mitigation Strategy

We get these questions a lot, and honestly, they're great ones. Let's clear up some common confusion around risk mitigation strategy and help you feel more confident about implementing your own approach.

How does risk mitigation differ from a business continuity plan?

Think of it this way: risk mitigation is like installing smoke detectors, fire extinguishers, and sprinkler systems in your building. You're working proactively to prevent fires from starting or spreading. A business continuity plan (BCP), on the other hand, is your detailed evacuation plan and instructions for setting up temporary operations elsewhere if the building does catch fire.

Risk mitigation focuses on reducing the likelihood and impact of risks before they occur. It's all about prevention and preparation. A BCP is your reactive game plan that kicks in during and after a disruptive event to keep essential business functions running.

The beautiful thing is how well they work together. The better your risk mitigation strategy, the less likely you'll need to activate your BCP. But if something does slip through your mitigation efforts, a solid BCP ensures you can bounce back quickly. It's like having both a strong immune system and a good doctor - you want both working for you.

How often should a risk mitigation plan be reviewed?

Here's the thing about risk - it never sleeps, and neither should your vigilance. Your risk mitigation strategy should be a living, breathing document that evolves with your business.

At minimum, plan for annual reviews to ensure everything still makes sense. But life rarely waits for scheduled check-ins. You'll want to revisit your plan whenever significant changes happen: launching new business operations, expanding into different markets, starting major projects, or when new regulations affect your industry.

External events can also trigger reviews. Remember how quickly the business landscape shifted during the pandemic? Or when supply chain disruptions suddenly became front-page news? These moments remind us why continuous monitoring (as we covered in Step 4) is so crucial - it helps you spot when it's time for an unscheduled review.

The key is staying flexible. Your plan from two years ago might not fit today's reality, and that's perfectly normal.

What is a risk register and why is it important?

A risk register is essentially your risk management command center - a centralized document that captures everything you've learned during your risk identification and assessment process.

Picture it as a detailed spreadsheet or database that lists each identified risk along with its category (operational, financial, strategic, etc.), potential impact, likelihood of occurring, priority level, and the assigned owner who's responsible for managing it. It also documents your chosen mitigation strategy for each risk.

Why is this so important? Because without a risk register, you're trying to juggle flaming torches in the dark. It provides that crucial systematic approach to tracking and managing risks, ensuring nothing gets forgotten or overlooked. When a new team member joins, they can quickly understand your risk landscape. When leadership asks for updates, you have everything organized and ready.

Most importantly, it keeps everyone accountable and on the same page. Instead of risks living in someone's head or scattered across different documents, your risk register becomes the single source of truth that guides your entire risk mitigation strategy.

Conclusion

Building an effective risk mitigation strategy isn't just about checking boxes or satisfying compliance requirements. It's about creating a safety net that lets you sleep better at night, knowing your business can weather whatever storms come your way.

Think of it this way: you wouldn't drive cross-country without checking your tires, packing a spare, and planning your route. Your business deserves the same thoughtful preparation. The companies that thrive aren't necessarily the ones that never face challenges – they're the ones that see challenges coming and know exactly how to handle them.

This proactive approach transforms uncertainty from a paralyzing force into a manageable part of doing business. When you've systematically identified potential risks, assessed their impact, and put solid mitigation plans in place, you're not just protecting your assets – you're building genuine business resilience that becomes a competitive advantage.

This isn't a "set it and forget it" process. The business world keeps evolving, and so should your risk management approach. New threats emerge, old ones fade away, and what seemed impossible yesterday might become tomorrow's reality. The key is staying nimble and keeping your finger on the pulse of change.

What makes all this effort worthwhile is the confidence it brings. While your competitors might be scrambling when the unexpected happens, you'll be implementing plans you've already thought through. That's the strategic advantage of good risk mitigation – it turns potential chaos into manageable challenges.

For organizations with employees traveling globally, the complexity multiplies significantly. You're not just managing business risks anymore; you're responsible for human lives across different time zones, cultures, and threat environments. The weight of that responsibility requires specialized expertise and round-the-clock support.

Partnering with a specialist like Safe Harbors can integrate robust travel risk protocols directly into your overall strategy, ensuring employee safety and business continuity no matter where in the world your team needs to go. Our expertise in global risk management means you can focus on your core business while we handle the complexities of keeping your travelers safe.

Ready to transform uncertainty from a threat into a competitive advantage? Take control of your organization's travel risks and build the kind of resilient business that doesn't just survive disruption – it thrives through it.